2023 Edition

How Much Does your Business Depend on Nature?

Climate Investments Today: More Harm Than Good?

Impact-Driven Private Equity

Building: A Sustainable Future

Debt to Impact, Turning Sovereign Obligations Into SDG Investments

Driving Purposeful Culture in Banking

Human Capital: a Key Driver of Productivity and Sustainable Growth

Tools for a Nature Positive Transition

Innovate4SDGs: Financing for Circular Start-ups in Emerging Markets

The Role of Financial Institutions for Sustainable Food Systems

Breaking Barriers: Web3’s Potential for Digital and Economic Inclusion

Robeco’s Sustainable Investing Open Access Initiative

ESG in DCF: A Not-So-Magic Formula to Price in Sustainability

Mainstreaming Impact Investing in the Pension Fund Industry

What’s Next for Nature Markets (In an Ever More Rapidly Changing World)?

Creating Framework Conditions for Sustainable Investment

Innovative Finance: The Path to a Sustainable Future

Scaling Climate Finance to Reach the Trillions

Accelerating the Energy Transition Through Financial Innovations

Towards a Unified Impact Measurement Framework for Impact Investing

Introducing the Swiss Stewardship Code

Energy Transition: Green and Just

Innovative Financing for Entrepreneurial Solutions in Emerging Markets

The Role of Insurance in Promoting Sustainability

Outcomes-based Financing for Nature-based Infrastructure

Electrification: the Greatest Opportunity in Capitalism’s History?

Foundations’ Assets Management: Performance & Benchmarking

Greening Real Estate Portfolio: Where Do We Start?

Building Bridges Between Investors and Local Nature-Based Solutions

Sharing Experiences on Natural Capital Valuation for Nature Positive Investment

Measuring the Impact of the Family Business Ecosystem

New Reality for Asset Owners

Cleaning up the Brazilian Gold Value Chain

Innovative Financing for Impact at Scale in Education

Peace Finance: The Case of Renewable Energy

Sustainability Trends in Commodity Trade Finance

Digital Money: Expectations, Realities, Prospects

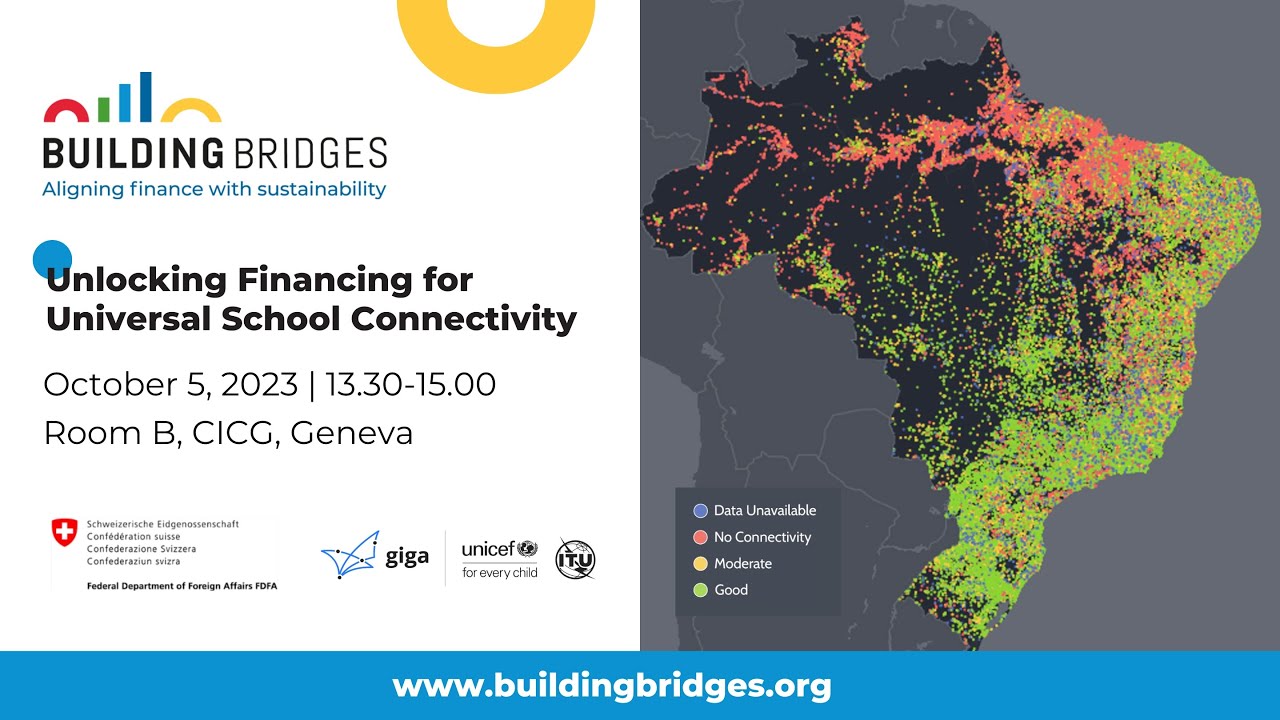

Unlocking Financing for Universal School Connectivity

Pathways to Financial Inclusion for Refugees and Migrants

Global Health Impact Investment Ecosystem

Rethinking Fiduciary Duty for Sustainability

Closing Event – The Future Belongs to Bridge Builders

ESG in Swiss Equity Research: Hot Topics

Second workshop under the Sharm el-Sheikh Dialogue

2022 Edition

Investing for Change in Africa

Nature Finance – The Next Wave

Gender Equality in the Financial Industry: Quo Vadis?

Helping Institutional Investors Build a European Impact PE Portfolio

Innovative Blended Finance Solutions for Impact

The Urgent Case for Inclusive Growth

What it Means to be Green

Markets for Nature: A Global Index for Biodiversity

Climate Crisis: THE Economic Opportunity of the 21st Century

The journey to Net Zero: Deep-dive into the Net-Zero Alliances

Valuing Water: Engaging for Systemic Change

Skin in the Impact Game: Building and Evaluating Sustainable Ventures

Rethinking Financial valuations: Integration of Sustainability Considerations

BlueImpact: Driving Capital to Blue SMEs

Beyond the Hype: Blockchain Infrastructure & Communities for the Global Goals

Net-Zero Initiatives and Forward-looking Methodologies

Disclosing Climate: From International Sustainability Standards to the Swiss Climate Scores

Biodiversity Credits and a Market for Nature

Plastic Waste: The Role of Finance in Finding Solutions through the Plastics Value Chain

Sustainable Infrastructure: New Investment Opportunities

TNFD as a Solution to Address Biodiversity Risks and Dependencies

Insuring Nature to Reduce Risks – Risk-transfer Solutions for Coral Reefs

Aligning Profits and Sustainability in Latin America and the Caribbean

Invest in Peace through Water

Accelerate2030 meets Geneva: Unlocking Financing for the Missing Middle

Sustainable Investing: Assessing Socio-economic Impacts of ETFs

Next Generation : Financing Future Climate Solutions

Measuring Human Rights for Investors

Energy Transition: From Global to Local

Biodiversity Footprinting of Portfolio: How to Scale It Up?

Fighting Off Blended Finance “Bad Press” with New Transformative Financing Models

Commercial Financing Unlocked for Sustainable MSME Trade in Developing Countries

Regenerative Finance – Web3 for Climate Action

The State of Impact Funds in Emerging Markets

Guidance on Impact Investing in Listed Equities

Remittances as a Financial Tool for Impact Investments and Impact Entrepreneurship

Leading Sustainability from the Boardroom

Engagement as a Mean to Impact the Real Economy

Investing in a Just Transition

Billions to Trillions – The Financial Opportunity of Building the Digital Bridge

Social impact Real Estate: moving beyond green building – Building Bridges 2022

Finance as a Driver of Peace

How Big Platforms Develop Green Digital User Journeys

Financing Climate Adaptation & Disaster Risk Reduction in Emerging Markets & Developing Economies

Infrastructure for Impact Accountability: Towards Standards for Quality Impact Reporting

Can Data Save Us from Greenwashing?

Impact Investment in Times of Crisis

The Sanitation Economy: where ‘Investment and Impact’ meet

All Along the Green, Social & Sustainability Bonds Investment Value Chain

The Criticality of Building Resilience against Physical Climate Risks

Commercially Scalable Global Health Solutions

Digitization Trends & Opportunities in Emerging Markets

Responsible Investment in Tech

Step by Step Guide to Natural Language Processing: Extract ESG Sentiment from Company Reports

Implementing Sustainability in Wealth Management

Sustainability and impact measurement and reporting: Where do we stand?

Ecosystem Restoration: the next frontier of environmental investing

2021 Events

Building Bridges Summit 2021

Gender Lens Initiative for Switzerland (GLIS)

Global Innovation for the SDGs: Accelerate2030 Meets Geneva

Building Bridges Voices 2021

Pavan Sukhdev, Founder and CEO – GIST

Alisée de Tonnac, Co-CEO and Co-Founder – Seedstars

Amina J. Mohammed, Deputy Secretary-General – United Nations

Christian Frutiger, Assistant Director General – Swiss Agency for Development and Cooperation (SDC)

Marianne Haahr, Executive Director – Green Digital Finance Alliance (GDFA)

Jerry Parkes, CEO and Co-Founder – Injaro Investments