Defining and Conceptualizing Impact Investing

A new special issue in the Journal of Business Ethics provides a first effort to establish a body of knowledge on impact investing from a business ethics perspective. Vanina Farber (IMD), a guest editor to the special issue alongside Kai Hockerts (CBS), Lisa Hehenberger (ESADE) and Stefan Schaltegger (Leuphana), analyzed impact investing across six dimensions: intentionality, additionality, contribution, materiality, measurability and attribution. This new analysis can help policy-makers and practitioners identify when and under what conditions impact investing can be a win-win for both investors and entrepreneurs.

In the paper “Defining and Conceptualizing Impact Investing: Attractive Nuisance or Catalyst?” the authors develop a conceptual framework to analyze the emerging field of impact investing, investments with the goal of generating measurable social and/or environmental impact alongside a financial return. Despite the relatively straightforward definition, the boundary conditions of impact investing have been hard to pin down because while some investors target market-rate financial returns, others may prioritize projects with lower financial returns or higher risk, but which promise potentially higher impact.

To address this issue, the authors model impact investing as a cluster concept with six dimensions: intentionality, additionality, contribution, materiality, measurability, and attribution. The use of cluster concepts is useful to explore the boundaries of impact investing and where tensions between financial and social goals may occur.

1. Intentionality

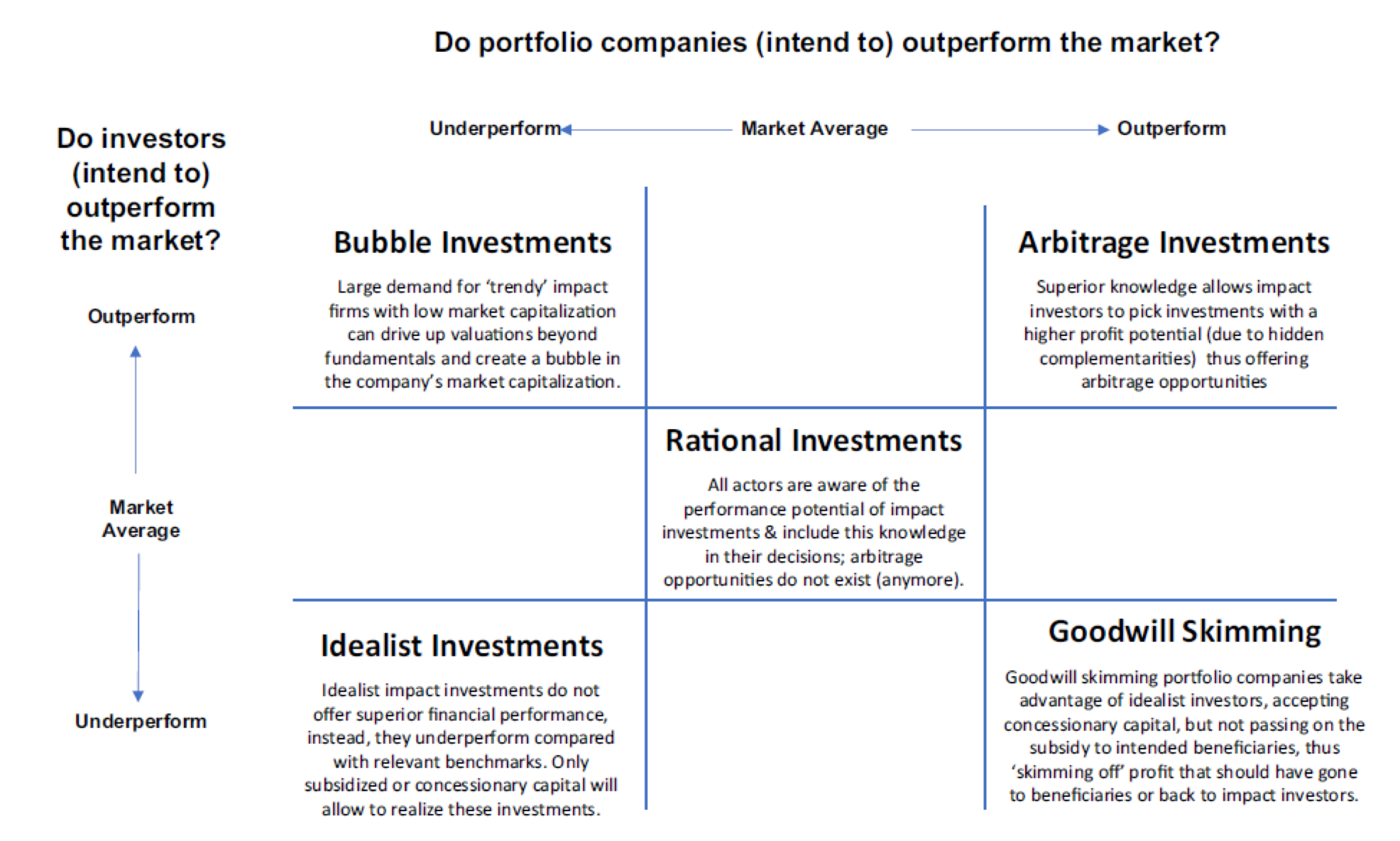

Intentionality is a crucial element of most definitions of impact investing. Impact investors must have a theory of change; that is, be intentional about how their investments will create social and/or environmental impact alongside financial returns. Without intentionality, the field opens itself to claims of “impact washing.” For example, few would argue that computers have had tremendous effects on learning and economic growth. Yet, in 1981 when David Marquardt of Technology Venture Investors (TVI) invested $1 million in Microsoft, he was focused on creating financial returns rather than societal benefits. One way to cluster impact investing models considers the financial return expectations of both impact investors and their portfolio companies (see Figure 1).

2. Additionality

A second dimension refers to the additionality of investments: would the impact have happened anyhow (does it just ‘float’ along the financial river), or is the investment targeted at fostering impact that would otherwise not materialize? Because additionality needs to measure outcomes against hypothetical (and thus unprovable) counterfactual states, it is often hard to determine the “impact” that investors and social enterprises claim to create. This opens several debates that need to be addressed: can additionality be self-certified by impact investors, or does it have to be assessed by independent parties? How should additionality be codified and regulated?

Figure 1. Sub-clusters of impact investments based on financial return intentions

3. Contribution:

A practice borrowed from venture capital, actively engaging investees through non-financial support or technical assistance is a core strategy to demonstrate the third principle of contribution. This strategy typically calls for adding value through board seats, mentoring, networking and training to strengthen an enterprise’s social impact, financial sustainability or profitability and organizational resilience.

Another way to demonstrate the contribution principle could be through signaling effects. Impact investors can signal that impact matters, for instance by integrating impact into their decision-making. This pushes investees to measure and manage impact and report their own impact contribution. Thus, by signaling the importance of impact, investors can push enterprises to prioritize impact-oriented strategies.

4. Materiality:

Investment materiality determines which information must be disclosed (because it is deemed substantial for decision-making of investors) and which information can be omitted (because it is assumed insignificant to investors). Materiality has been transferred to impact investing to visualize a company’s sustainability engagements. Materiality assessment therefore emphasizes stakeholder engagement to enable the reporting of such data. It encourages discussion and dialogue on what is considered relevant impact information.

Attempts to express material information in an easily comprehensible way include different tools such as social return on investment calculations, or the impact weighted accounts pioneered by Harvard Business School. However, placing monetary value on impact requires assumptions about how much something is worth and to whom. This can create tensions between investors and investees or between managers of an investment fund and their own investors because people tend to weight impact objectives differently.

5. Measurability:

Impact measurement requires a clear understanding of the impact goal, providing a link between measurability and intentionality. To correctly measure impact, outcomes should be adjusted for effects that others achieve (alternative attribution), effects that would happen anyway (deadweight), negative consequences (displacement), and effects that decline over time (drop-off).

Measurement and assessment always entail valuation by preparers/senders as well as receivers of performance information. No matter how much data is collected and how ‘objective’ the data presumably is, the decision to collect specific data as well as the choice of indicators are value judgements. Accordingly, measurement choice, data acquisition and interpretation of results should be embedded in a multistakeholder process.

6. Attribution:

Finally, attribution is perhaps the most abstract concept in impact investing. It is about attributing the impact to a specific ‘source’ or actor, making it possible to understand who was responsible and thus who should be rewarded for the change.

These findings have important implications for policymaking and practice. The EU Sustainable Finance Disclosure Regulation (SFDR) introduces various disclosure-related requirements for financial market participants and financial advisors across the entity, service and product levels. The new EU rules aim to ensure transparency and comparability for pre-defined ESG metrics within the financial markets while curbing abuses such as impact washing. Understanding the various dimensions of impact investing can help structure stakeholder conversations, indicating where tensions are likely to occur and where best practices can be used to advance the industry into mainstream financial markets.

The full collection of papers included in the special issue can be found here.

For more information:

Hockerts, K., Hehenberger, L., Schaltegger, S., & Farber, V. (2022). Defining and Conceptualizing Impact Investing: Attractive Nuisance or Catalyst?. Journal of Business Ethics, 1-14. Available at: https://link.springer.com/article/10.1007/s10551-022-05157-3

Guest Contribution from SL4SF