Category: Guest contribution

Guest contribution

The Bill is Due: Physical-Hazard Revenue Losses Mount, Plans Lag

Guest contribution

From ideology to economics – sustainable investing enters a new era

Guest contribution

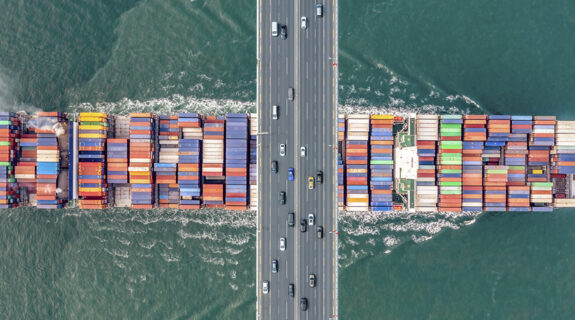

Sustainable supply chains: The missing link in the climate transition

Guest contribution

Exploring Intergenerational Collaboration in long-term investing

Guest contribution

The Augmented Analyst: A New Paradigm for ESG Analysis

Guest contribution

Smooth your path to net zero – A comprehensive analysis of transition plans

Guest contribution

From Hidden Threat to Core Risk: Finance Confronts Nature Loss

Guest contribution

ESG Backlash as a Chance for Renewal

Guest contribution

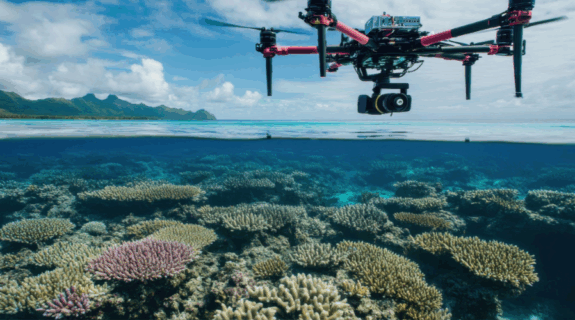

Nature Tech: Cutting-edge Technology in the Service of Biodiversity

Guest contribution