Beyond Rhetoric: Keeping Track of Impact Investing

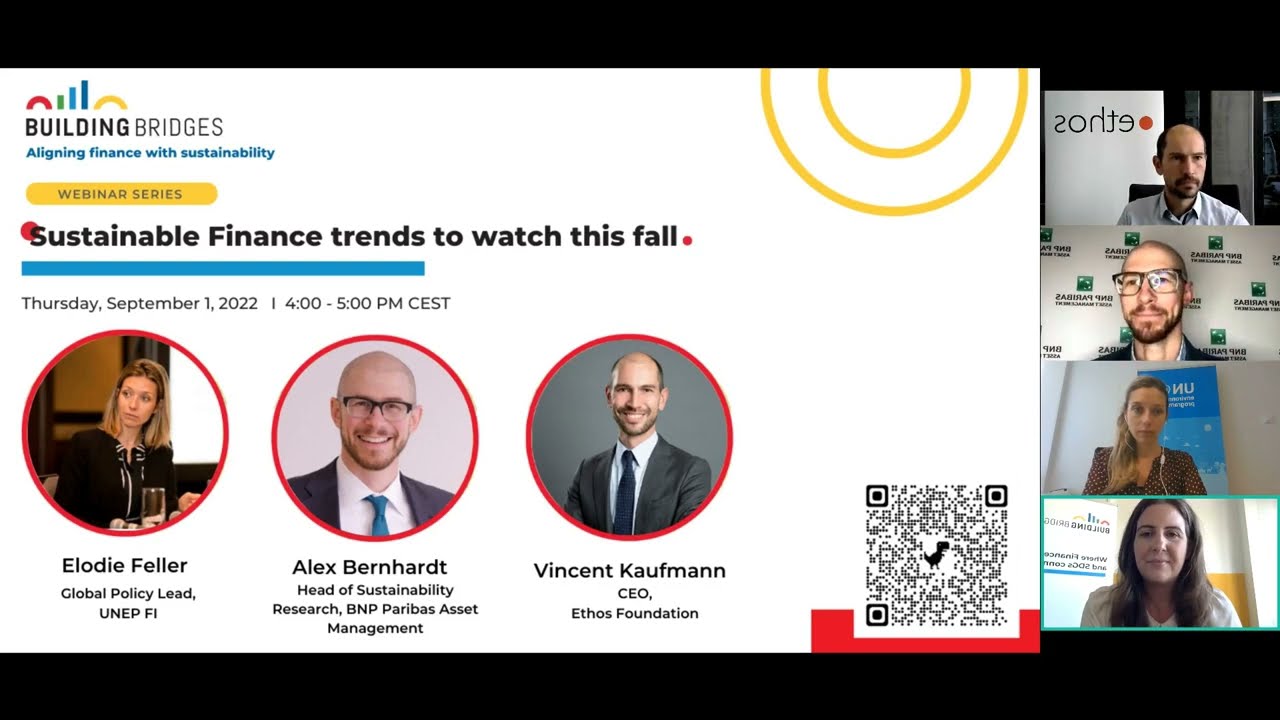

To kick-start the month of September, Building Bridges hosted a webinar dedicated to the main sustainable trends of the fall with leading experts such as Élodie Feller, Global Policy Lead at UNEP FI, Alex Bernhardt, Global Head of Sustainability Research at BNP Paribas Asset Management, and Vincent Kaufmann, CEO at Ethos Foundation.

While net zero emissions commitments are constantly increasing, accountability mechanisms are not always applied. Ms. Feller underlined that new tools will be made available to ensure that the finance industry can effectively monitor the real impact of investment strategies, and their ability to meet sustainability objectives. The United Nations Secretary General’s high-level group will be issuing recommendations regarding net zero commitments for Non-State entities, not only destined to assist the financial sector, but also to guide policy-makers and help them create enabling conditions for sustainable finance practices and impact investing.

While admitting that many actors of the financial sector are unfortunately simply talking the talk and not walking the walk, Ms. Feller pointed out that financial regulations in terms of transparency are nonetheless picking up, contributing to making voluntary disclosure mechanisms the norm.

Mr. Kaufmann put great emphasis on the vital role data plays in attaining the UN sustainable development goals. He noted that “the more reliable the data we will be able to acquire, the more we will be able to integrate it in our decision-making process, and ensure true sustainable investment practices.” As a practitioner, Mr. Bernhardt pointed out that data can contribute to lifting the current aura of confusion and uncertainty that prevails in the industry, and help assess the social and environmental impact of investment strategies.

For him, more transparent voluntary disclosure mechanisms and easily accessible data exemplify the move towards impact investing witnessed in the industry. Mr. Bernhardt also underlined the mainstreaming of Environment, Social & Governance standards that are being implemented across the board. This is sustained by the growing number of investors now committed to the United Nations Principles for Responsible Investment and by the value of the assets managed according to these principles – now reaching over USD 100 Trillion. He also indicated that this is precisely what consumers are demanding, and is a bold move towards impact investing.

Panellists also discussed the recent European green taxonomy that was adopted in the summer regarding the identification of renewable energies in which asset managers should be investing to contribute to the transition. While noting that by including the gas and nuclear sectors the European Union sent the wrong message, Mr. Kaufmann still believes that it constitutes an important basis for companies to disclose their green revenues as clear standards have been established. In fact, this enables the usage of common and comparable key performance indicators and eases the disclosing process, and contributes to mitigating the recourse to greenwashing tactics.

Despite the current volatility observed on financial markets due to the war in Ukraine, panellists pointed out that the march to sustainability and impact investing cannot be stopped. However, Mr. Bernhardt underlined that certain jurisdictions are coming back to fossil energies because of energy supply concerns. He underpinned that one of the main solutions in this regard is to augment the investments in the field of renewable energies and low-carbon technologies, as they tend to be deflationary in the longer term, to tackle the issue of climate and to enhance domestic security.