Balancing Regulation between Complexity and Transparency

The range of collective capital investments with sustainability strategies has multiplied over the past 20 years. As the number of sustainable funds increases, accusations of greenwashing make the rounds on the market. Standardizing sustainability performance records will pave the way for greater transparency.

The 21st century has been marked by the debate about sustainability. Today, sustainability stands for a number of approaches including amongst others the exclusion of controversial business models and practices, decarbonisation, ESG Integration, thematic- or impact investing. Against this background and given the ubiquity of sustainability, it seems plausible that interest-driven sustainability concepts could also develop in the investment industry. The topic received particular boost from the EU Commission with its “EU Action Plan” in 2016. Its overarching goal is to redirect capital flows towards sustainable investments.

Many calls for transparency

The EU Action Plan pushes for the implementation of a total of ten measures.[1] Three of these measures directly relate to the demand for greater transparency: 1) Sustainability benchmarks: Developing transparency for methods and characteristics; 2) Sustainability among institutional investors/asset managers with obligations regarding inclusion and transparency; 3) Transparency for companies: Strengthening rules regarding the disclosure of sustainability information and financial reporting (EU taxonomy).

The contradiction: A significant increase in complexity

The EU taxonomy, aims to ensure that participants and markets have a common understanding of what is sustainable and what it is not, is considered by many to increase bureaucracy. The USA, Great Britain and China are working on their own taxonomies. Listed, internationally active companies will need to meet the requirements of each of these taxonomies in order to remain investable in the medium to long term.

Standardisation is a must

Institutional investors will need to create more transparency about how their products provide capital for sustainable activities. Despite the dozens of sustainability frameworks and rating agencies, true transparency will ultimately only be possible through standardisation and an associated reduction in complexity. Associations such as the Asset Management Association Switzerland (AMAS) are also pointing to a viable path of self-regulation with the aim of strengthening the credibility of Switzerland as a sustainable financial center.

How to recognise sustainable added value

Creating transparency remains a challenge, given the multitude of sustainability strategies. Are Swiss investors informed enough to assess sustainable added value when it comes to sustainability? According to a 2021 study by ETH Zurich with over 3000 Swiss investors, the Swiss have some catching up to do in terms of “sustainable financial literacy”.

Best practice With its extensive sustainability reporting for all sustainable funds Zürcher Kantonalbank’s asset management aims to demonstrate transparency. The detailed documentation of its voting and engagement activities may also set a benchmark in terms of transparency within the Asset Management industry.

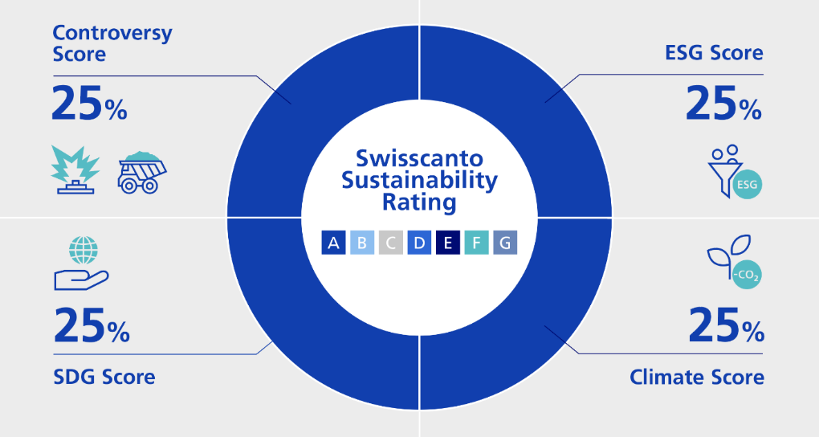

The proprietary Swisscanto Sustainability Rating, for example, enables investors to see at a glance how sustainable their investment is: from A (high) to G (low). States and companies are assessed based on four indicators for sustainability: controversy score, ESG score, climate score, and impact score

[1] Ten measures to implement the EU Action Plan:

Overview of measures in the action plan: The financing of sustainable growth by the EU Commission (cric-online.org)

Guest contribution by Fabio Pellizzari, Head of ESG Strategy & Business Development, Zürcher Kantonalbank Asset Management.