After an inflationary spike resulting from the pandemic and war in Ukraine, central banks had to raise interest rates. In line with their mandate, they are attempting to slow down the economic cycle to bring inflation back to its target level. While investors are familiar with the context, the current cycle is unusual because it has emerged after a long period of exceptionally low interest rates, followed by a short period of rapid rate increases.

This swift rise has exposed a whole series of underlying vulnerabilities that are now coming to light. The recent collapse of some banking institutions in the United States and Europe reminds us of the fragility of certain sectors. The ongoing contraction of bank lending will weigh on economies, and the prospect of recession could become a reality over the coming months. Geopolitical insecurity further adds to this fragile financial environment. This all suggests that markets will remain relatively volatile and uncertain for some months.

Investment conviction

Although the current market environment naturally leads us to be cautious, the climate transition clearly represents one of the most important opportunities for long-term investors.

Today, powerful forces are at work to encourage and support the climate transition that is now vital: consumer pressure, regulatory action, the transformation of industrial business models and fair capital allocation by investors. Government action also plays a part, through public investment programs and tax credits. The climate transition will be built around four main axes:

- Electrification: Electricity is becoming the dominant energy carrier. From around 20% of global energy demand in 2020, it will account for over 70% by 2050. To produce electricity, we will need to switch from fossil fuels to renewables (hydro, wind, solar and certainly nuclear).

- Agriculture and nature conservation: By 2050, we will need to feed two billion extra people while returning large arable areas to reforestation and biodiversity projects. We will need to rethink our production and consumption methods.

- Materials: This will involve decoupling the economic growth pathway, which we want to remain strong, from that of commodity extraction. The ‘take, make, waste’ model will need to be replaced by ‘reduce, re-use, recycle’. Construction materials must be rethought; cars will be shared and their components recycled.

- Carbon: The market economy model must expand to include all its externalities. Carbon emissions will need to become increasingly expensive, creating essential incentive mechanisms for industrial players to adopt genuine transition strategies. In parallel, proven carbon sequestration will open the door to monetary transfers that were inconceivable until recently.

As in the industrial revolution of the 19th century or the IT revolution over the last fifty years, these transformations will have a major impact on all our economic systems. Leading companies will emerge stronger, others will disappear.

Solutions exist

Most of the technologies needed for these transformations already exist. They are currently evolving into mass market solutions. We are on the verge of an exponential acceleration of these industrial solutions that should release unprecedented growth opportunities.

Several factors are driving this acceleration. First, the fall in production costs: in the renewable energy field, costs have plummeted by 60-90% over the last ten years. Next, constant improvements in performance: electric vehicles are reaching energy efficiency of around 80% compared with 20% for conventional vehicles. Finally, massive support from public bodies, to the tune of hundreds of billions of francs for the three major blocs of Europe, the US and China, are helping to speed up investment and the implementation of large-scale industrial solutions – in the field of heat pumps, electric vehicles and construction materials, for example.

The war in Ukraine is another accelerating factor: we note, here, a renewed conviction in Europe regarding the importance of true energy independence.

Aligning portfolios with the ongoing transition

To benefit from investment opportunities linked to the climate transition, it is vital that we understand its nature and trajectories. This requires real, fundamental research. It is necessary to analyse the maturity level, returns and growth potential of the different technologies and to model their development. The challenge is to be able to anticipate the nature of major impending changes that will no doubt shake up many economic sectors and give rise to new business models.

It is useful to follow the investments made by companies, which often point to future sources of profitability. The energy transition alone is expected to account for almost CHF 3,800 billion in global annual investment over the next ten years. This figure is comparable to the capital expenditure of the information technology sector, which now represents nearly 20% of total returns of global companies, compared to just 5% in the 1990s. Reflecting what happened in this field, we must prepare for the emergence of the new GAFAs of tomorrow.

The climate transition is no longer a mere theory. It is no longer a distant project. We are firmly convinced that this transition has now begun. It is in motion. In many respects, it is accelerating. Investors must ask themselves: do we want to ignore it, or, on the contrary, should we not systematically integrate it into our portfolios?

Guest contribution written by Frédéric Rochat, Managing Partner at Lombard Odier Group.

This week, the Intergovernmental Panel on Climate Change (IPCC) released its new report that provides a five-year analysis on global temperature rises, fossil fuel emissions and climate impacts. This new synthesis report on climate change calls for more ambitious action and more effective policies on climate mitigation to limit the global average temperature below 1.5°C.

IPCC’s report underlines the urgency of the climate crisis, presents its causes, and lists its direct impacts on populations and biodiversity. In 2018, the Intergovernmental Panel stressed the unprecedented scale of the crisis. While progress in adaptation planning and implementation has been observed in 170 countries since 2018, current data shows that global warming will continue to increase in the near term, and projected long-term impacts will escalate with every increment of warming. Scientists explain that effective and feasible solutions to reduce greenhouse gas emissions are available, and that securing a liveable and sustainable future will depend on the actions that countries will take in the next ten years:

“Adaptation options that are feasible today will become constrained and less effective with increasing global warming. With increasing global warming, losses and damages will increase and additional human and natural systems will reach adaptation limits. Maladaptation can be avoided by flexible, multi-sectoral, inclusive, long-term planning and implementation of adaptation actions, with co-benefits to many sectors and systems.”

IPCC’s report underlines that the impacts of climate change will only get worse if deep, rapid and sustained actions are not implemented in this decade. Governments, companies, and civil society need to work together to transition to a sustainable system.

Building Bridges is seeking Communications Interns to support the planning of the 2023 edition that will take place on 2-5 October in Geneva. The Communications Interns will work from June 1 to October 31 and develop content for the communication channels of the initiative.

Building Bridges is an open and collaborative effort that aims to accelerate the transition to a more sustainable economy in Switzerland and abroad. To this end, Building Bridges promotes the finance community’s contribution to realizing the SDGs. The initiative provides a forum for discussion and cooperation among financial and other private sector actors and institutions, public authorities, international organizations, as well as not-for-profit and academic stakeholders dedicated to achieving the transition to a financial system that is fit for the future.

Duties, Responsibilities, and Output Expectations

Reporting to the Building Bridges Head of Communications, Interns will:

- Draft content for social media channels (Twitter, Linkedin)

- Identify key influencers on social media and ways to improve audiences

- Update web pages on WordPress

- Update and publish content on the mobile application

- Prepare social media cards

- Publish videos on YouTube

- Draft content and prepare visuals for the newsletter

- Provide support for online events

- Update lists on the database

- Contribute to the preparation of promotional documents

- Conduct research and tracking of the latest developments related to sustainable finance that may be relevant to the initiative

- Carry out any other ad hoc or communications tasks, as may be required to support the 2023 edition

- Manage general contact forms

Qualifications and Experience

The ideal candidate has a/is:

- Entrepreneurial mind-set, able to take initiative and work in situations of uncertainty

- Organized and detail-oriented, but capable of managing detail in the context of the “big picture” (milestones, outcomes)

- A strong ability to multitask and be conscientious and efficient in meeting commitments, observing deadlines, and achieving results. Takes ownership of all responsibilities and is a self-starter

- Listens to others, correctly interprets messages from others and responds appropriately; asks questions to clarify and exhibits interest in having two-way communication; demonstrates openness in sharing information and keeping people informed.

- Diplomatic and a team-player, single-minded in working towards compromise to achieve objectives

- Genuine interest in sustainability and finance

- Comfortable working with all levels of seniority across industry sectors

Your experience and qualifications:

- University degree (complete or in progress) in communications, finance, economics, international relations, development studies, political science, intergovernmental affairs, or a related field

- Previous experience in communications or marketing

- Speaks and writes clearly and effectively in English (fluency in French an advantage)

- Proficiency with technology including basic tech tools and online tools such as WordPress, Canva, Mailchimp, SurveyMonkey, Social Media, etc.

- A strong ability to multitask and be conscientious and efficient in meeting commitments, observing deadlines, and achieving results. Takes ownership of all responsibilities and honors commitments

- Strong teamwork skills and ability to collaborate and work with a wide range of individuals at varying levels of seniority and subject-matters

- Listens to others, correctly interprets messages from others and responds appropriately; asks questions to clarify and exhibits interest in having two-way communication; demonstrates openness in sharing information and keeping people informed

What We Offer

- Remuneration in-line with industry standards

- An exceptional opportunity to be involved at the heart of the sustainable finance and SDG finance ecosystem in Switzerland and internationally, and to learn about and to meet a broad range of players that are leaders in their field and determined to see the financial sector evolve towards maximizing impact towards achieving the SDGs

- A unique opportunity to learn about the fast-evolving sector of sustainable finance

Application

Please complete the application form and attach your CV by April 6, 2023. For additional questions, please contact Nora Sada, Head of Communications.

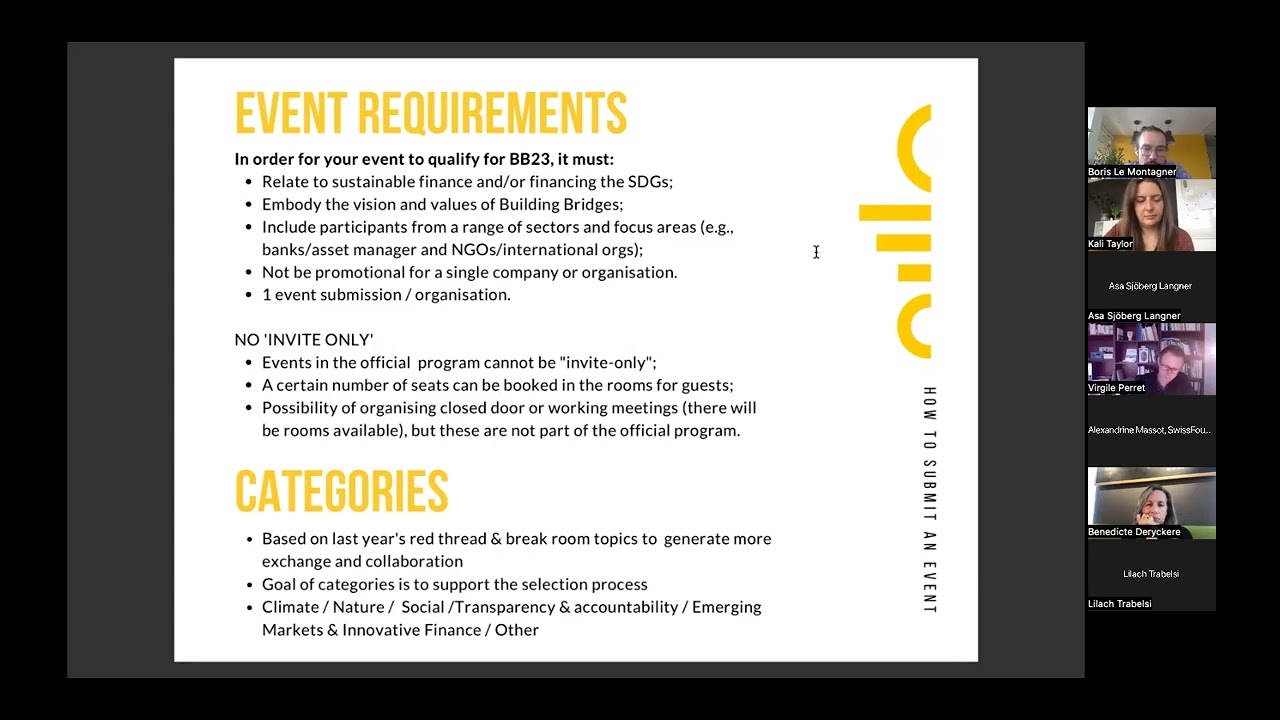

The 2023 edition of Building Bridges will showcase 60+ events, workshops, research presentations, panels, and fishbowl conversations. We invite all members of the community to help us advance sustainable finance, highlight innovative projects and create impactful discussions at Building Bridges 2023.

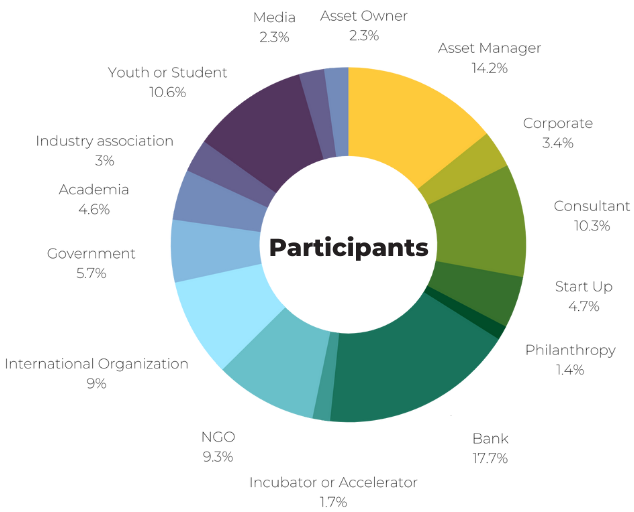

The Building Bridges Action Days will take place from October 3-5, 2023 at the CICG in Geneva. All types of organizations are encouraged to put forward their event concepts, whether they be finance industry players, academics, NGOs, international organizations, governments, or industry associations.

Building Bridges is an internationally-focused event, and therefore we welcome event applications from organizers based anywhere in the world.

Event Formats: