Financial inclusion has emerged as a powerful tool for enhancing the resilience of households and fostering economic growth in emerging and frontier markets. Symbiotics, the leading market access platform for investing, is at the forefront of this movement, driven by a mission to expand access to finance for low- and middle-income households in emerging and frontier economies. This commitment to sustainable development is demonstrated in the company’s 2022 Impact Report.

The 2022 Impact Report closely follows the three pillars of Symbiotics’ Impact Promise, demonstrating impact through several measurable KPIs.

Emerging Economies

Symbiotics defines its investment universe as emerging and frontier economies, targeting low- and middle-income markets and beneficiaries. Symbiotics seeks to deploy capital to where it normally doesn’t flow, reaching out through investments.

Responsible Investments

Symbiotics integrates in its investment process environmental, social and governance ‘ESG’ risks that might affect the value of its investments. Symbiotics also screens for environmental and social adverse impact that its activities may have on its target markets.

Sustainable Objectives

Symbiotics assigns sustainable objectives to each of its investments, and report on key impact indicators tracking them, aligned with the Sustainable Development Goals “SDGs” framework. Symbiotics aims to measure the positive development and contributions of its activities.

Targeting Emerging Economies

Symbiotics managed assets worth USD 2.9 billion and invested in more than 320 financial institutions across 79 countries. The top 3 countries of investments are India, Ecuador and Costa Rica, together representing 20.3% of the Symbiotics’ exposure. The investment distribution is as follows:

- Latin America & the Caribbean: 30.8%

- South & East Asia: 28.4%

- Eastern Europe, Central Asia & MENA: 23.8%

- Sub-Saharan Africa: 13.5%

The highest standards of Responsible Investment

Symbiotics firmly embraces the double materiality principle outlined in the Sustainable Finance Disclosure Regulation “SFDR”. The company addresses sustainability risks that could impact its financial performance, as well as considers how its investment choices affect broader sustainability factors that ultimately impact the world. As an impact investor focused on benefiting low- and middle-income households and MSMEs, Symbiotics and all of its funds fully align with the rigorous requirements of Article 9.

Reaching Sustainable Objectives by Empowering Borrowers

In 2022, Symbiotics successfully served a total of 2.8 million individuals, 70% of them women and almost half from rural communities, providing access to various financial products and services. These diverse financial offerings collectively played a role in improving the quality of life of the end borrowers. The median average loan provided was USD 2,700, supporting more than 10 million jobs across various sectors.

Guest contribution by Symbiotics

The relationship between food systems and environmental health is a key topic in current discussions about the transition to a more sustainable future. Today’s food production methods and food consumption are already putting our natural resources under pressure and generating significant greenhouse gas emissions, thus intensifying climate change. This situation is set to become even more acute as a result of population growth. Against this backdrop, there is an urgent and indisputable need to transition to a regenerative or “nature-positive” food system that has the potential to deliver food security for billions of people worldwide while protecting our planet.

Our current food system is capable of feeding the vast majority of the world’s population. Thanks to a century of innovation, crop yields have reached unprecedented levels and significant progress has been made in reducing hunger and malnutrition around the globe. However, this progress has come at a high cost: Food production is today a major contributor to climate change and is also harming the natural world’s ability to recover by degrading land productivity, water resources and soil health.

At the same time, rising temperatures and the extreme weather events associated with climate change are now making it harder to grow food – impacting yields and reducing the nutritional value of the food produced, not to mention harming aquatic systems and leading to the increased prevalence of pests and disease. This “vicious cycle” in which food production and climate change are locked represents a real threat to food security. Together, these developments underscore the need to fundamentally alter the way food is produced, processed and consumed in today’s world. Further, the UN Food and Agriculture Organization (FAO) estimates that by 2050, it will be necessary to produce about 50% more food based on the existing food system in order to feed a larger global population of around 10 billion.

From nature-negative to nature-positive

To feed the world sustainably, today’s “net nature-negative” food system must become “nature-positive” – ensuring the non-depleting and non-destructive use of natural resources based on a regenerative system of agriculture. Food production within a regenerative food system enhances land and water management, safeguards biodiversity, and restores the health of soils and forests, while helping to lower greenhouse gas emissions. Advances in technology, including AI, robotics biologicals and genetics, can also boost the efficiency of food systems and thus support the transition to a regenerative food system.

Minimising food loss and waste, particularly within households, is another important action point, given the scale of this problem at present. Progress in this area could help to reduce the amount of additional food that needs to be produced and thus help to lower greenhouse gas emissions from

agriculture. Crucially, consumers can make a key contribution to this goal by changing their dietary preferences and avoiding overconsumption.

Food for thought

Balancing the rising demands of a growing global population with the urgent need to drive environmental sustainability is a massive challenge. However, the tools for change − ranging from regenerative agricultural practices to sustainable consumer habits − can provide tangible solutions to help increase food security and drive environmental sustainability, benefiting people and the planet.

Guest contribution by Melanie Beyeler, Senior Portfolio Manager, EFG Asset Management

Don’t miss our event on the role of financial institutions for sustainable food systems at Building Bridges 2023!

After the hard work of producing climate-stressed economic pathways, financial institutions face the challenge of converting these into projected financial impacts on their own book.

For lenders, credit risk is generally perceived to be the most material transmission channel. To model this, the impact on borrowers, and hence of default, needs to be assessed. We now look at the two most material cases for retail banks.

Corporate Loans

Certain corporates are particularly exposed to transition risk, including firms in the energy, transport, extraction and manufacturing sectors. Corporate loan stress testing typically relies on projecting counterparty-specific financial statement data, and thence deriving stressed probabilities of default.

Key Challenge: Time Horizons

The time horizon can extend more than 30 years into the future, presenting challenges around modelling the evolution of company financials. Complex behaviour is seen in components of the P&L such as dividend issuance and the drawdown and repayment of debt. So careful calibration is required to model plausible firm behaviour under stress.

Key Challenge: Double Counting

Climate change scenario providers capture physical risk within their macro-economic scenarios. However, it is not always clear whether this physical risk assessment is limited to systemic impacts, or whether it also includes microeconomic channels, such as blended price impacts arising from physical hazards on individual properties. A detailed Integrated Assessment Model, such as that run by KPMG, gives full control and transparency around which risks are included or excluded.

Residential Mortgages

Residential mortgage portfolios are likely to be subject to significant physical and transition risks, impacting both the obligor and the value of the collateral.

The policies required to achieve a reduction in emissions will result in impacts on borrowers. For example, regulations around energy performance standards drive retrofitting costs. Broader macroeconomic effects through disorderly transition scenarios can cause general economic malaise, resulting in increased unemployment.

Pre-eminent physical threats vary by geography. Chronic risks such as subsidence and coastal inundation are liable to increase under ‘hot house world’ scenarios. And extreme weather events such as flooding, wildfires and storms are likely to increase in both frequency and severity.

Key Challenge: Forward-Looking Physical Risk

Physical hazard events can be modelled as shocks to borrowers’ income. However, as borrowers start to build a more forward-looking view of physical risks, these additional costs are likely to start being reflected in the value of a property. Contemporaneous consideration of physical risks may therefore be insufficient to capture impacts on collateral value. One solution is to incorporate these adaptive expectations into the projection of physical risk impacts on collateral value.

Key Challenge: Missing Data

Retrofitting costs are a key aspect of transition risk for mortgage holders. To model these effectively it is necessary to know current energy efficiency levels. In the EU and the UK, EPC (Energy Performance Certificate) ratings are used as a measure of energy efficiency, while in Switzerland the GEAK (Gebäudeenergieausweis der Kantone) is the predominant standard. Completeness of data on the housing stock varies by country, and data imputation techniques are usually required to produce a useful dataset.

In summary, climate scenario analysis is still a young science, with industry consensus yet to be reached on several important topics. However, the pressure on banks to solve the problems discussed above, among others, will only increase as the climate emergency deepens.

Guest contribution by Owen Matthews, Director Financial Services, KPMG

Humanity is at a crossroads. The pace of life is accelerating rapidly, with technological breakthroughs sending wave after wave of disruptive transformation around the globe. At the same time, the fragility of our planet and our social structures is becoming ever more obvious.

The alarm bells are ringing so loud, it’s deafening. We all urgently need to rethink where our world is headed and take bold, innovative action to change our collective trajectory.

In a fast-moving world, only those who adapt will thrive. Vontobel has a fiduciary duty to act in the best interests of its clients, and has a long track record in and firm commitment to rigorously seeking out and sharing impact investment opportunities that will positively influence our world and our society. The focus is on empowering you to drive positive change.

To achieve your investment targets while aiming for tangible and measurable impact, even when the goalposts keep moving, the company aims to adapt and thrive, whatever the future has in store.

The Vontobel 2023 Impact Investor Survey

Favored investment approaches, investor motivation, public and private markets, measuring impact, where the main opportunities and challenges lie. These are some of the topics covered in the Vontobel 2023 Impact Investing Survey, in which they gathered the views of nearly 200 investors, both institutional and professional, from 21 countries throughout Europe, Asia Pacific, and North America.

Guest contribution by Vontobel

Don’t miss our event on ESG in Swiss equity research at Building Bridges 2023!

Global efforts to standardize sustainability reporting are coming to fruition, with the EU’s Corporate Sustainability Reporting Disclosures (CSRD), the inaugural IFRS Sustainability Disclosure Standards and Switzerland’s Ordinance on Climate Disclosures (Climate Ordinance) all on the radar of companies in Switzerland.

In this article, we explore why the release of the new IFRS Sustainability Disclosures Standards is an opportunity to prepare for sweeping sustainability reporting requirements.

IFRS Sustainability Disclosures Standards

In June 2023, the International Sustainability Standards Board (ISSB) issued its first two IFRS Sustainability Disclosure Standards:

- IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information

- IFRS S2: Climate-related Disclosures

These much-anticipated standards are the result of intensive and accelerated efforts by the ISSB, which was only founded in November 2021. Both IFRS S1 and IFRS S2 are effective for reporting periods beginning on or after 1 January 2024, although a simplified transition option is available for the first year. Mandatory application of IFRS Sustainability Disclosure Standards depends on each jurisdiction’s endorsement or regulatory processes. Besides, there is – currently – no formal requirement for IFRS adopters to also apply IFRS Sustainability Disclosure Standards.

Situation in Switzerland and overlap with ISSB

The Climate Ordinance enters into force on 1 January 2024, requiring large public-interest entities to make climate-related disclosures for the 2024 financial year. The ordinance reflects the Federal Council’s commitment to the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), including mandatory climate disclosure rules.

IFRS S1 defines general requirements on the types of information to disclose about sustainability-related risks and opportunities. Those are derived from the four TCFD pillars: Governance, Strategy, Risk management, and Metrics and targets.

IFRS S2 is the ISSB’s first topic-based standard and requires entities to provide information about their exposure to climate-related risks and opportunities. In Switzerland, climate-related matters have to be included in the financial reporting if they are material from a financial perspective.

Preparing for now and next

The sustainability-related reporting landscape is set to get more complex for all organizations in coming years. As companies prepare to meet the requirements of the Swiss Climate Ordinance, it’s a good time to consider their (future) exposure to other, international regulations. Companies should analyze now if, where and how standards like the new IFRS Sustainability Disclosure Standards will affect them, considering where they operate and whether they already report under IFRS.

Preparing to comply with new standards almost always demands a review and refresh of data, systems and process capabilities. Successful implementation relies on early and full engagement of internal stakeholders, while an effective communication strategy is also recommended to ensure external stakeholders benefit from the sustainability-related information.

Outlook

Swiss and international stakeholders are increasingly demanding robust, reliable and relevant sustainability-related information. While overlap can be observed between ISSB and other sustainability regulations, there are also differences. Against this background, Swiss companies should review their own sustainability approach. A forward-looking view supports efficient systemic changes, allows synergies to be leveraged and enables flexibility amid regulatory shifts.

Guest contribution by EY

Don’t miss our event on sustainability reporting at Building Bridges 2023!

From daily bread to daily headline, food is a hot topic. Pasta shortages panicked shoppers during the pandemic, while today’s high inflation has fueled steep increases in the cost of the weekly shop.

But what’s going on behind the scenes where consumers don’t usually see? After years of operating on outdated technology and production methods, the global agrifood system – which produces what’s on the world’s plate – has reached breaking point.

Today’s agrifood systems are responsible for 30% of global greenhouse gas emissions and 70% of freshwater use, yet a third of all food produced is wasted. Current food production methods are also responsible for 80% of deforestation; are the primary driver of biodiversity loss; and have devastated soil quality. In Europe, 60-70% of all agricultural soils are degraded as a direct result of unsustainable management practices (United Nations Development Programme, 2022).

With the global population expected to grow to 10 billion by 2050, and food demand to rise by 60% in this time, the stresses on our food systems are set to hugely increase.

Is there hope? Yes, but our agri and aqua-culture practices require urgent and profound transformation to reduce their harmful environmental impacts, provide a growing population with a sustainable diet and adapt to the evolving pressures of climate change. This necessary transformation is creating unprecedented investment opportunities across the global food value chain.

Drivers of change: Regenerative practices, technology & consumer demand

At the heart of the solution are regenerative agricultural practices. These are systems of producing food that don’t just limit harm, but actively restore nature and reverse environmental damage at each stage of the process. More importantly, regenerative practices offer a way to bolster food production while meeting climate goals through carbon sequestration and responding to the biodiversity targets set out in the Global Biodiversity Framework agreed at the COP15 last year.

Technology has a huge role to play in accelerating the transition towards sustainability. Satellites, drones, robots and machine-learning technology are finding their place in fields to aid farmers in understanding their soil, improving its quality and refining the use of chemicals. Traditional farming practices, like raising cattle for beef, can be remodeled into less resource-depleting approaches, such as high-protein, low-carbon insect farming. Closer to the consumer end of the process, blockchains and IoT can support more efficient supply chains and reduce food waste.

A cornucopia of opportunity

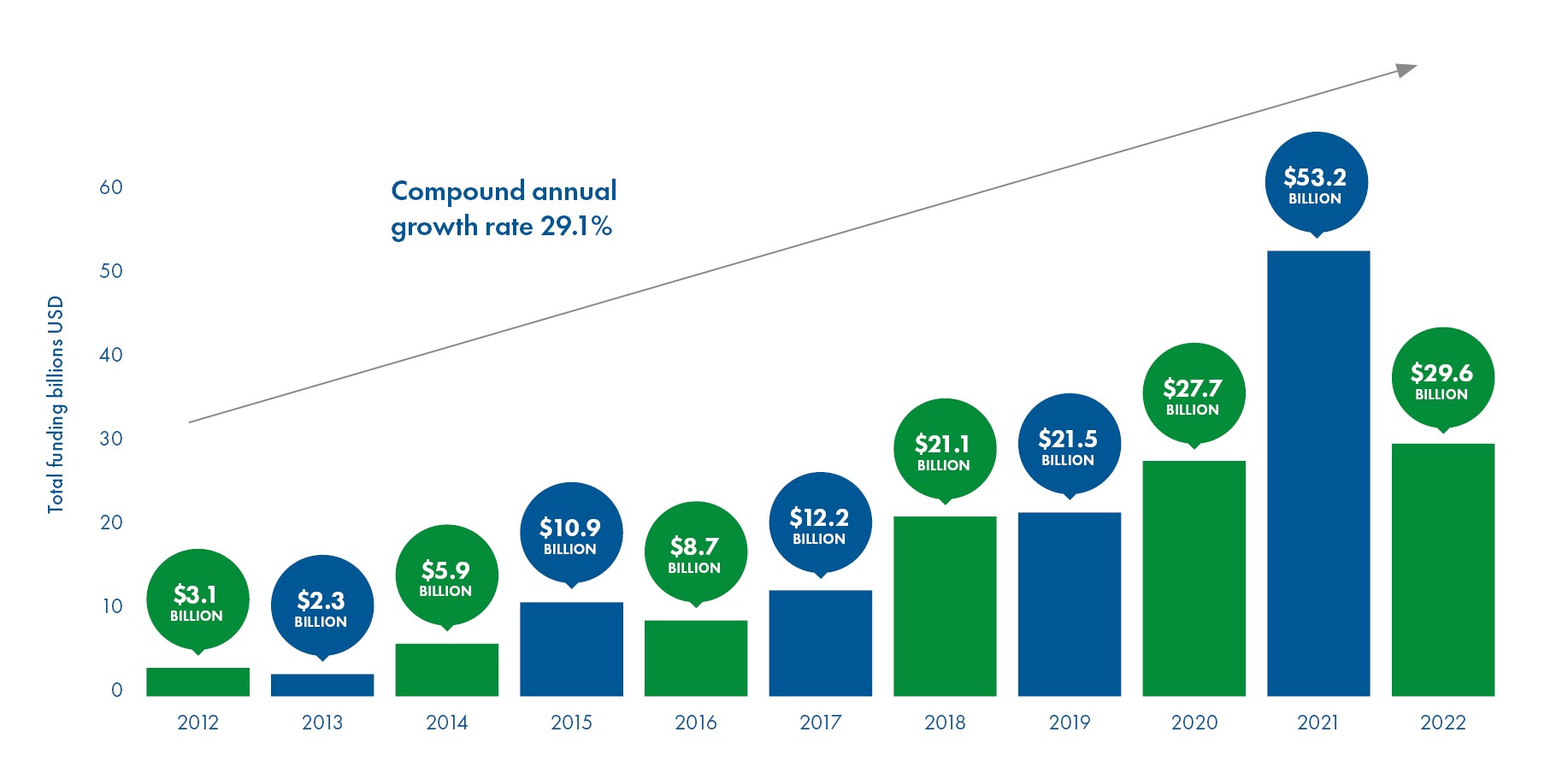

The agrifood tech innovation market has grown sixfold since 2012 and is forecast to reach USD700bn by 2030 (UBS, 2021). Three sectors are driving change around resilience and sustainability.

1. Precision Farming – the shift to ‘agriculture 4.0’. Using technologies like drones and AI to improve resource efficiency, pesticide use, carbon sequestration and productivity in food production.

2. Alternative nutrition – creating new food sources that are as attractive as today’s mainstream animal proteins.

3. Food waste – targeting operational efficiency from sourcing through to warehousing and distribution, as well as upcycling traditionally wasted food elements into desirable products.

Source: AgFunder Global AgriFoodTech Investment Report, 2023

The amount of investment needed to transform our food systems is estimated by the Good Food Finance Network to total USD300-350 billion a year from now until 2030. This is a huge standalone figure, but for context, it seems relatively modest in comparison to the amount pledged to the Covid-19 recovery. More importantly, it is dwarfed by the enormous potential business opportunities we expect to see in sustainable, healthy, equitable food investments and the societal value that these investments can unleash.

Guest contribution by Fabio Sofia, Co-Manager of the Regenerative Growth I strategy offered by Z Impact Ventures in partnership with Mirabaud Asset Management. This strategy invests in companies that are creating solutions to our broken food systems.

There is an increasing understanding about the interconnectedness of the climate and biodiversity crises – and, to a degree, an acceptance that both issues must be addressed together. But what is missing is true collaboration between all relevant stakeholders to ensure that their individual efforts truly sum up to change at large scale.

The food sector is uniquely positioned to tackle the intertwined climate–nature challenge. Global food systems are responsible for around 30% of global emissions, 70% of fresh water use and up to 80% of tropical deforestation and habitat loss. The food value chain also contributes almost a fifth of global GDP and is responsible for 40% of jobs globally. This, together with the scale and reach of the food value chain and the vast number of very small operators therein, means that “fixing food” is central to winning the climate and nature crises, without leaving people behind economically.

The finance sector can play a substantial role in such a transition to a sustainable food system. A factor that tends to stop growers from transitioning to more sustainable practices tends to be the cost, so bridge financing, subsidies and loans with sustainability incentives can make a meaningful difference.

However, even though the upstream part of the food value chain touches thousands of individual growers, approximately two thirds of the revenue is generated by less than 1% of companies. This means that the behaviour of large multinational businesses is key to achieving large-scale change in the food system. The equity holders of these companies can and must play a role in this transition.

Of course, they can exercise this influence through voting, at AGMs. It is also increasingly commonplace for shareholders to engage directly with management or the Board on specific issues. Collective engagement, where several shareholders unite to address a particular matter, has proved to be powerful too, particularly when the voices represent a meaningful part of the company’s equity.

As important as these tools are, none of them get to the root of the problem – why is there such a disconnect in the first place? Partly, perhaps, because the protagonists are acting in silos. On the whole, the conservation sector does not talk to shareholders, who do not talk to academics, who do not talk to corporates. For change to happen at scale, we need all stakeholders to talk to each other so as to understand the challenges and barriers to change and collectively ‘buy in’ to a solution that benefits all.

With a mission to foster such an open exchange and collaboration, UBP’s Biodiversity Committee, which is central to the governance of its biodiversity strategy, is comprised of representatives from Cambridge Conservation Initiative, Peace Parks Foundation, and the finance world, and chaired by world-renowned conservationist Tony Juniper. To identify the barriers impeding the progress of companies in the food value chain to protect and restore biodiversity without compromising the food requirements of society, we recently leveraged the collective expertise and experience of our Biodiversity Committee and portfolio holding companies during a workshop on the food sector.

Providing the space for such a collaborative exchange has proved highly beneficial to all stakeholders as they were able to talk openly and jointly identify challenges, thereby ensuring that they reflect the views of all relevant stakeholders. Specifically, three key barriers emerged: regulatory requirements (e.g. TNFD, SBTi etc.), the difficulty of measuring biodiversity, and the lack of consumer interest and awareness on nature. In a next step, we will work with the stakeholders to explore these topics in more depth with the aim of providing some solutions and stimulus for corporate change.

So, can listed equity managers support a shift to a more sustainable food system? On their own, around the edges, with other shareholders, to a degree, but as a facilitator of deep collaboration, yes absolutely.

Guest contribution by Victoria Leggett, Head of Impact Investing, Union Bancaire Privée

Don’t miss our event on food systems at Building Bridges 2023!

The CCIG defends the interest of its 2,500 members. When it comes to sustainability, we see a multitude of opinions, sometimes contradictory. We need to embrace this diversity and bridge economy and sustainability. For this reason, the CCIG has been working to provide a framework for companies to exchange their experience in terms of sustainability as well as a possibility to acquire knowledge in terms of sustainable management.

More than 10 years ago, the CCIG, the state of Geneva and the HEG Geneva (Geneva’s university of applied sciences) partnered to promote sustainable management and encourage companies to share their experiences. This was the beginning of the Sustainable Management Meetings (RMD in French), the very first edition of which took place at the CCIG on November 18, 2011. Since then, with four editions per year, the RMD have proven to be a success, with over 1,000 participants from local companies.

Over the years, we have seen that implementing the principles of sustainable development makes it possible to revitalise the management of companies to gain in coherence and in overall performance. Corporate social and environmental responsibility has taken on increasing importance, and more and more companies in Geneva are integrating sustainable development into their strategy.

Providing a framework for leaders and CSR professionals to exchange their experience is key. But it is equally important to allow them to acquire the necessary tools and methods for them to carry it in their companies. This is why, the CCIG is also supporting the Diploma of Advanced Studies (DAS) in Sustainable Management of the HEG Geneva. This one-year, part-time cursus (equivalent to 30 credits ECTS) allows the participants to acquire expertise and professional-oriented tools to establish a corporate social responsibility (CSR) approach in their companies or to help other companies implement one. At the end of the cursus, students will receive five internationally recognised certifications. Today, the DAS in sustainable management is a well-recognised cursus. The board must regularly open a waiting list due to the high demand.

In conclusion, companies are working under the double constraints of economic performance and sustainable business. On the long term, the two are aligned. Some of our members understood it a long time ago and are already well engaged in the path toward sustainable business. In fact, they have more to teach us than the other way around. However, in the short term, it can be worrying for many entrepreneurs who sometimes do not know how to start. The CCIG believes that the majority of companies are willing to do something if we provide them with suitable solutions. This is why the CCIG will continue to develop new tools able to bridge those two needs. The historical challenge humanity is facing today cannot be overcome without companies or against them.

Guest contribution by CCIG.

Through the Sustainable Investing Open Access Initiative, Robeco shares its Sustainable Investing Intellectual Property to promote and encourage research and ideas. The platform highlights Robeco’s SDG Framework and Country Sustainability Ranking (CSR). The SDG framework offers free insight into individual SDG scores for corporate issuers.

This proprietary SDG Framework is a robust tool that systematically evaluates companies based on their performance across key SDG-related targets. A company’s overall performance across the most strategically relevant SDGs aggregates into an overall company SDG score. The resulting SDG scores are used to construct portfolios that pursue positive impact and avoid negative impact, thereby advancing sustainable progress in the economy, society and the natural environment.

Why are they relevant to investors?

SDG Investing is about impact investing. This differs from ESG integration, which focuses on avoiding financial risks that stem from poor performance on environmental, social and governance issues. SDG scores can identify which companies are expected to have significant negative impact and which ones can or will provide sustainable solutions.

1. Investors indicate that they want to align their investments with the SDG goals, now and in the future, with 18% saying they had made it a high priority. A further 40% said they would consider doing so over the next two to three years.

2. SDG Investing lets investors zoom in on their own goals. With 17 SDGs to choose from, there’s no shortage of issues that an investor can use to zoom in on their own ambitions, allowing them to direct and manage exposure to their chosen SDGs. This has helped make sustainable investing something specific and measurable.

3. Achieving the goals leads to massive business opportunities as it means investing in the companies whose products and services can progress them, from making telecoms accessible in remote areas to rolling out healthcare and education facilities to a wider populace. Some companies and sectors are naturally more attuned to contributing to the SDGs than others, which in turn has directed investment flows.

4. We can identify how companies contribute to the SDGs when they make products or offer services that help achieve one or more of the 17 goals. Some business by their nature contribute to particular SDGs, while others may be better placed to contribute to a whole theme or bucket, such as meeting basic needs

All in all, the SDGs provide a framework to define a sustainable philosophy and priorities at a corporate level, track progress over time, and use a consistent reporting methodology that can be applied across the majority of asset classes.

Guest contribution by Robeco.

Join Robeco on October 3 at Building Bridges 2023 to learn more about the Sustainable Investing Open Access Initiative.

The energy transition offers a once-in-a-generation investment opportunity that can help investors address the climate crisis and generate attractive returns. Our investment philosophy is based on e three-pillar framework – Leaders, Adaptors and Solutions.

Analyses show that sustainable portfolios can generate consistent returns while mitigating risks and contributing to positive change. Responsible investments are a growth industry in Switzerland. Sustainable funds now have a record total volume of CHF 799.5 billion (as of June 2022). Investors currently have more opportunities than ever to make a difference. Bond investors play a crucial role in this field.

As capital providers, bondholders have an important say. The transition to the emission-free world of the future will only succeed with unprecedented changes in industries of all kinds – from transport to energy to manufacturing. The energy transition will require investment especially in industries in need of modernisation and renewal. Investors who want to make an impact on energy transition do not necessarily have to invest in “green” bonds. There are numerous bonds from non “green” issuers that contribute to climate change mitigation. As an example, a company producing high emissions but wanting to switch to renewable energy can reduce important CO2 outputs compared to a company that hardly produces any emissions. These types of companies can become market leaders, changemakers, adaptation facilitators or solution providers.

Market leaders include companies such as a Portuguese multinational energy company leading the transition to renewable energy, as well as an American based technology computer manufacturer, which has set and is pursuing ambitious targets for reducing energy consumption, transitioning to renewable energy and mitigating emissions within the supply chain. A supplier of aluminium packaging to the beverage industry and a manufacturer of personal care and household products, is also a market leader. The company is aggressively seeking to reduce its carbon footprint and offers aluminium products that can be recycled infinitely – the current recycling rate is very high. The company sees more growth opportunities in switching from plastic packaging to sustainable aluminium.

Adaptation facilitators include sovereign green bond issuers such as Chile and the Netherlands, which use the proceeds from bond issues to finance practical adaptation measures, such as protection against flooding due to climate change. Other examples include a manufacturer of drainage pipes that support and facilitate the management of water flows in drought- and flood-prone areas of the world. Around 60% of the company’s piping is made from recycled plastic, and the company recycles 250,000 tonnes of plastic per year.

Solution providers include companies such as Brazil’s largest railway operator. Rail transport is five times less carbon intensive than road transport. In addition, the company invests in engines that consume less diesel. Around 85% of total sales are considered green sales, as they are generated by transporting goods with automated, energy-efficient locomotives.

When thinking of buying bonds, the in-depth analysis of companies is crucial. Projects that can be convincing from a climate protection point of view must not be at the expense of other environmental goals, for example, dams that generate electricity from hydropower must not endanger biodiversity and access to water. There is no doubt that investors in credit securities play a crucial role in the transition to a more sustainable economy.

This guest contribution was written by Thomas Leys, Investment Director at abrdn.