There is a growing imperative to increase youth participation in meaningful action around sustainable finance. This event takes you on a transformative journey through a design-thinking workshop where young minds, industry professionals, and academics will create a Youth Engagement Strategy(YES) with the aim to unleash innovation, bridge the generational gap, and forge a global network shaping the future of finance.

This 60min fishbowl session aims to showcase the innovative finance vehicles created by non-profit organizations and supported by philanthropies, explore the challenges they faced in their development, and identify the lessons learned that can inspire others to pursue similar approaches.

After a short introduction to our new study which systematically analyses the impacts (both positive and negative, direct and indirect) of the insurance sector on biodiversity and climate, a fishbowl discussion is facilitated. Participants are encouraged to discuss the implementation of specific concepts and recommendations highlighted in the report.

How professional investors can facilitate the transition through their investments ?

Chatham House-style workshop looking at different asset classes for professional investors to exchange on the challenges and best practices to effectively invest in the transition to net zero.

Join us in driving climate action and empowering corporates to comply with regulations and gain a competitive edge. Our expert team will share insights from the Swiss Climate Reporting Forum and Blueprint, offering actionable steps to leverage climate reporting benefits. Make a meaningful impact in the fight against climate change.

Join the global health impact investment ecosystem to connect around supporting innovators changing the equitable delivery of healthcare worldwide, particularly in the Global South. Whether a seasoned VC or an aspiring angel, an innovator with an idea or a funded founder, join us for a community building experience.

Whilst global instability is a defining feature of our time, conflict risks remain overlooked by investors. We explore what peace finance is and the practical steps investors and companies can take to address conflict risks by looking at the renewable energy sector and its impact in fragile and conflict-affected settings.

Satellite data provides opportunities for regulators and companies to monitor climate change, manage carbon footprints and assess investment risks. The Scottish Government together with its industry and academia will lead an interactive discussion on innovation in the space sector and its positive impact on ESG reporting.

In this highly interactive workshop we will discuss the difference between ESG & real and concrete Impact, how everyone defines them, debate about real investment opportunities and how the perception of impact really differs from one person to another . Bring your critical hat!

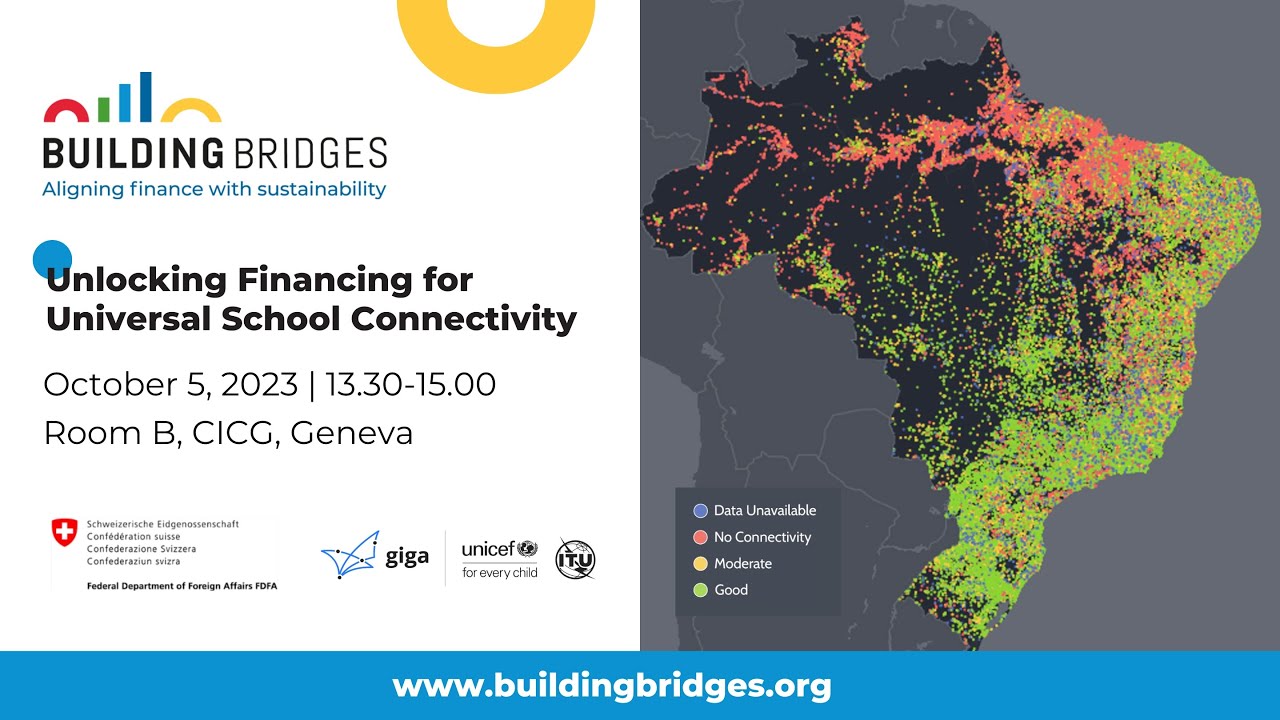

A Fireside Chat with finance and technology experts on innovative financing mechanisms for school connectivity. This session explores innovative approaches and mechanisms to finance for digital infrastructure projects, with a particular focus on school connectivity, as a means to achieve universal connectivity by 2030.