In a world grappling with complex environmental challenges, the need for transformative solutions has never been greater. From climate change to biodiversity loss, the stakes are high, and time is short. Yet, innovation—the kind that fundamentally rethinks how we interact with our planet—often struggles to gain traction in traditional corporate settings. This is where impact investment initiatives, such as those championed since 2010 by ONE CREATION, play a pivotal role in nurturing the startup ecosystem to drive meaningful environmental change.

The Power of Impact Investment

Impact investment is not just about financial returns; it’s about creating tangible, positive outcomes for society and the environment. Unlike traditional investment approaches, impact investing prioritizes ventures that deliver measurable ecological benefits alongside economic value. For initiatives like the ONE CREATION Awards, this means spotlighting and supporting startups that are not only commercially viable but also dedicated to solving pressing environmental issues.

By channeling capital into early-stage ventures, impact investors provide crucial resources for scaling innovative solutions. Whether it’s developing cutting-edge technologies for carbon capture or pioneering new methods of sustainable agriculture, these investments catalyze solutions that could redefine our environmental future.

Startups as Catalysts for Change

Innovation thrives on agility, risk-taking, and a willingness to disrupt the status quo, qualities inherent to the startup ecosystem. Unlike established corporations, which often face resistance to change, startups can rapidly iterate, pivot, and adopt groundbreaking technologies.

Large corporations, despite their resources, frequently struggle to integrate disruptive technologies into their legacy systems. Their business models often make adopting sustainable practices slow and cumbersome. Startups, by contrast, are born out of the need to innovate and address market gaps. This positions them uniquely to tackle environmental challenges head-on, often introducing solutions that were previously unthinkable.

For instance, emerging startups in renewable energy, waste management, and circular economy practices are already demonstrating their potential to transform industries. These ventures provide scalable solutions while inspiring larger players to adapt, creating a ripple effect throughout the economy.

Why Innovation Needs Investment

Innovation, especially in the environmental sector, requires significant upfront investment. Research and development, testing, and scaling new technologies are resource-intensive endeavors. Without access to funding, even the most promising ideas can falter. This is where initiatives like the ONE CREATION Awards make a difference. By providing financial support and visibility to early-stage startups, these awards bridge the gap between concept and commercialization.

Furthermore, the visibility offered by platforms like the Building Bridges conference amplifies the impact of these startups. It connects them with investors, policymakers, and industry leaders who can accelerate their growth and integration into broader markets.

Building a Sustainable Future

Impact investment is more than a financial strategy; it is a commitment to fostering a sustainable future. Supporting startups that are reimagining solutions to environmental challenges is essential if we want to make significant progress. The innovations emerging from these ecosystems hold the potential to revolutionize industries and redefine our approach to sustainability.

– This contribution is brought to you by ONE CREATION, a valued bronze event partner of Building Bridges 2024.

As part of our mission as a cantonal bank, we are committed to working for the sustainable development of society. Our socially responsible investing (SRI) policy is in line with this commitment. We strive to communicate on our efforts in this area in a transparent, clear, and simple way, and to raise our clients’ awareness of SRI issues. We also consider it our fiduciary duty to incorporate ESG approaches into our broader investment policy. We seek to offer a wide range of responsible investment solutions that are in line with market best practices and generate competitive long-term returns.

We also intend to solidify our position in this market by working with local and national entities through research conducted in collaboration with the University of Lausanne (UNIL) on ESG investing and through our partnership with SRI specialist Ethos. BCV’s asset management team manages a range of investment funds covering the main asset classes, with Ethos serving in an advisory role. In addition, BCV subscribed to Ethos’s shareholder engagement services, marking an important step forward in its efforts to hold a dialogue with the companies in its investment funds and discretionary management portfolios.

– This contribution is brought to you by BCV – Banque Cantonale Vaudoise, a valued bronze event partner of Building Bridges 2024.

Switzerland has a long and distinguished history in impact investing, establishing itself as a pioneer in making microfinance accessible to private investors. Today, it ranks among the top three countries globally for private market impact investments, supported by a robust network of specialists. Yet, despite all its progress, impact investing remains somewhat niche, and there is an increasing call for action to integrate it more fully into mainstream financial strategies.

SSF, in collaboration with Tameo Impact Fund Solutions (Tameo), has recently published “A Stocktake of Swiss Impact Investing”. The report is built on two data sets. First, data from the SSF Swiss Sustainable Investment Market Study 2024 captures impact investing as a self-declared sustainable finance approach, totalling CHF 180 billion AuM. This volume is held across a large variety of asset classes, with private debt and private equity making up only 5% of AuM and the majority being held in listed equity (31%) and real estate (25%). These assets were mostly invested in the environment sector (21%), the housing/community development sector (13%), the health sector (12%) and energy sector (11%).

Second, data from the Tameo Private Asset Impact Fund Report 2023 demonstrates that Swiss-managed private asset impact funds (PAIFs) comprise a considerable share (12%) of the global PAIF market (USD 95.3 billion), placing Switzerland among the top 3 countries for AuM in PAIFs. In 2024, there were 18 impact asset managers in Switzerland with a total of 83 funds with a combined AuM of USD 11.2 billion. The most popular sector for impact investing was microfinance with 65% AuM.

But besides looking at the state of impact investing today, the report more importantly aims to make recommendations on how to address barriers for further growth and thereby provides the basis for future collaborative efforts between different actors in the Swiss impact investing space.

In order to further expand the potential of Swiss managed capital toward impactful outcomes, collaboration is needed between different actors from the financial sector such as mainstream asset managers, foundations and pension funds and the investees that receive capital. This is why the “Swiss Platform for Impact Investing” is launched as the Swiss National Partner to GSG Impact at Building Bridges on 12 December. This Swiss Platform will further Swiss expertise through collaboration between actors and is hosted by Swiss Sustainable Finance (SSF). The Swiss Platform will work to leverage the expertise from within the market, with different organisations taking the lead on different projects, amongst them SSF. All work will be overseen by the Swiss NP Executive Board.

The Swiss NP will be pushing for projects that:

- Engage the Swiss ecosystem around impact investing

- Create clarity and transparency in the Swiss financial market on impact investing

- Increase flows of capital toward impact investing

- Provide an expert voice for Swiss impact investing

To get involved with the Swiss NP, join the Network.

– This contribution is brought to you by Swiss Sustainable Finance, a valued founding partner & event partner of Building Bridges 2024.

Marie-Laure Schaufelberger is a key figure in the field of sustainable finance. Pictet Group’s Head of Sustainability, who has also served as the President of Sustainable Finance Geneva for the past three years and Vice-Chair of the annual Building Bridges Summit, is someone with convictions, which her employer has always promoted since she joined the bank.

Having gained experience in corporate sustainability and as a product specialist for Pictet’s thematic investment strategies, in 2018, she put forward a proposal to the Managing Partners to create a head of sustainability position for the Group. “We already had well-positioned products on the asset management side but we also had to think about private wealth management, and create a real culture of sustainability, reinforcing it as part of our DNA and our business model.” Her arguments hit home.

A unified vision

Five years after her position was set up, she is now head of Pictet’s newly created Group Sustainability Office, reporting directly to the Managing Partners in a strategic cross-functional role.

Schaufelberger’s team is working on understanding Pictet’s environmental and social footprint, which mainly comes from the investments it manages on behalf of clients. This includes analysing the impact of shareholder engagement and client mandates. “Responsible, credible and solid products and solutions should emerge”, she adds. “Performance indicators will be used to measure that.”

Impact, in addition to ESG

Sustainable products focus primarily on environmental and social impacts. They focus on alternatives to fossil fuels, but also regenerative energy. The latter “involves investing in businesses that repair and replant natural areas and regenerate the soil.”

In the early days of sustainable finance, the notion of ESG was limited to managing the impact of environmental, social and governance factors on a portfolio’s risk/return profile. Now, the aim is to make a real impact, as well as deliver financial returns. It is possible to beat the market through positive impact investments in some sectors, but requires fundamental analysis and rigorous stock selection.

“Companies having a positive impact account for only a fraction of the market today,” says Schaufelberger. “The key is therefore to identify companies that are in the process of transitioning their businesses towards a more sustainable alternative. This can include the transition from fossil fuels to renewables, and all those companies that are going from brown to green, from degenerative to regenerative.”

This universe spans across listed assets to private equity and real estate. The latter sector is energy intensive and needs to make the transition to much more energy-efficient standards, with an accompanying re-rating. “Large institutional clients are the largest property owners, so the stakes are high for our pension funds.”

“European regulations have played a major role in aligning standards and promoting transparency and end-client protection,” says Schaufelberger.“However, if regulation becomes too prescriptive and not incentive-based, there is a risk of simply ‘ticking boxes’ in terms of compliance rather than redirecting capital towards solutions that have a positive impact and help with the transition. What is true for regulation is also true for the framework conditions and when it comes to developing new investment vehicles and managing systemic risks. We need a much more sustained dialogue between governments, civil society and economic players, in the form of public-private partnerships.”

Adapted from the article by Myret Zaki, originally published in French in Bilan.

– Author: Marie-Laure Schaufelberger, Head of Sustainability, Pictet Group

– This contribution is brought to you by Pictet Group, a valued diamond event partner of Building Bridges 2024.

Artificial intelligence (AI) is touching almost every corner of the global economy. But what are the implications for environmental, social and governance (ESG) issues?

On the one hand, AI brings powerful potential to tackle the myriad of ESG data challenges that investors face. On the other hand, it brings investment risks around data protection, labour rights, and energy and water consumption. What do investors plan to do about AI?

The impact of AI on ESG issues is just one of the thought-provoking issues we explore in our 2024 Global ESG Study, which gathered the views of 1,130 institutional investors and intermediaries across Europe, the Middle East, North America and Asia-Pacific[1].

Investors look to AI for help tackling ESG data challenges

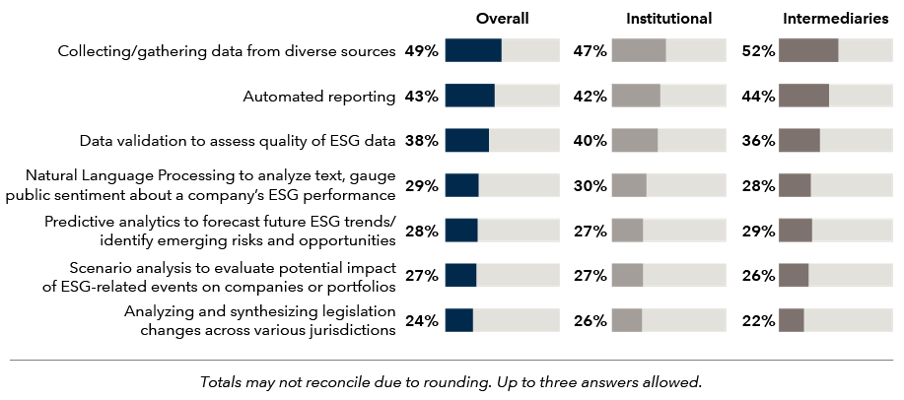

Among the barriers to ESG adoption, difficulties with the consistency and reliability of ESG data have been widely cited for some time in our annual study. AI may help solve the ESG data puzzle. Although only 10% of respondents in the survey currently use AI to analyse ESG data, more than half plan to do so in the future. The potential of AI to enhance ESG data gathering and reporting is a promising development for investors seeking to improve their ESG strategies.

Areas where AI is expected to most aid ESG analysis

The rise of AI brings new ESG investment risks

While AI offers potential data solutions, it also introduces new ESG investment risks, in particular “S” risks.

Six out of 10 respondents in the study see the social impact of AI as the most material “S” issue over the next 12 months. More than two-thirds believe that will likely be the case over the next three years.

Data protection and privacy, cited by three-quarters of respondents, is seen as posing the most material AI-related risk for investment. Labour rights/job displacement is viewed as another material social risk related to AI.

AI’s transformative potential is powered by high electricity consumption. It should come as no surprise that more than half of respondents view energy consumption and greenhouse gas emissions from AI as a material ESG risk in investing over the next two to three years. About a quarter of respondents point to AI-induced pollution and e-waste issues as a key risk.

Our ESG Global Study aims to shine a light on important trends among investors, and given the rise of AI, it was one of the topics we explored. Beyond the valuable insights on AI-related issues, what hasn’t changed compared to last year is perhaps more striking. Amid political and legislative challenges, evolving regulations and elevated geopolitical risk, a vast majority of the investors surveyed remain committed to ESG.

All data attributed to Capital Group and ESG Global Study 2024 unless otherwise stated.

Marketing communication

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

This communication is issued by Capital International Management Company Sàrl (CIMC), unless otherwise stated, which is regulated by the Luxembourg CSSF – Commission de Surveillance du Secteur Financier.

In Switzerland, this communication is issued by Capital International Sàrl, authorised and regulated by the Swiss Financial Market Supervisory Authority (FINMA).

In the UK, this communication is issued by Capital International Limited, authorised and regulated by the UK Financial Conduct Authority.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company. All other company names mentioned are the property of their respective companies.

© 2024 Capital Group. All rights reserved.

[1] The survey was conducted online by CoreData Research during May and June 2024.

– Author: Jessica Ground, Global Head of ESG Capital Group

– This contribution is brought to you by Capital Group, a valued bronze event partner of Building Bridges 2024.

Despite global efforts to combat climate change, the world is not on track to meet the Paris Agreement’s crucial goal of limiting global warming to 1.5°C. Progress has also been slow against the 17 Sustainable Development Goals (SDGs) the UN introduced in 2015 with the aim of ending poverty, protecting the planet and ensuring peace and prosperity for all by 2030. With six years left, only around 17% of these goals are on track.2 New tools and innovative solutions are urgently needed to tackle multifaceted challenges. This is where Artificial Intelligence (AI) comes in: It excels at processing vast amounts of diverse data, allowing it to facilitate scenario development, accelerate strategy evaluation, optimise operations and monitor progress, allowing for deeper insights into complex systems.

AI is already making significant contributions to all the SDGs in areas such as healthcare, food aid and solving supply chain issues. One of its most essential roles lies in tackling climate change, in alignment with SDG 13 (Climate Action). AI has the potential to drive climate progress across key areas including:3

- Mitigation: AI can help to reduce and remove greenhouse gas emissions by optimising energy consumption, enhancing efficiency and facilitating renewable energy development.

- Adaptation and resilience: AI can help prepare for and respond to the impacts of climate change through early-warning systems, optimised resource allocation and scenario modelling.

- Foundational capabilities: AI can advance climate economics, enhances education and fosters innovation, enabling more accurate predictions and supporting new technologies.

In many areas, there already is a measurable real-world impact. For example, AI-powered tools now provide actionable flood forecasts through accurate projections well in advance of extreme weather events.4 In agriculture, AI helps forecast weather and crop yields, develop sustainable pest control and predict soil erosion. Additionally, it can identify low-carbon compounds to replace high-emission materials in engineering.

AI also has transformative potential at the company level, and nearly 75% of large businesses have already integrated it into their strategies.2 It can conduct advanced data analysis, provide intelligent decision support and increase efficiency. By applying AI capabilities, companies can accelerate sustainable development across areas including operational efficiency and reduced environmental impacts, sustainable value chains, and risk management and resilience.2

While AI holds great promise, it also entails certain risks. Without responsible oversight, AI could cause environmental and social harm. It can generate biased outputs – including through the underrepresentation of marginalised groups in training data –, produce factual errors, increase resource consumption and potentially accelerate job displacement and the spread of misinformation.

Nevertheless, AI has significant potential to boost progress towards the SDGs. By effectively integrating it into our global strategies and fostering collaboration among governments, businesses and communities, we can address challenges more efficiently. Harnessing AI’s capabilities can help us to bridge the gap between our current efforts and the ambitious targets we have set.

1 Sustainable Development Solutions Network, Sustainable Development Report 2024

2 United Nations Global Compact and Accenture, Gen AI for the Global Goals, 2024

3 BCG and Google, Accelerating Climate Action with AI, Nov 2023

4 McKinsey, AI for social good: Improving lives and protecting the planet, May 2024

Read the full article here.

– Author: Melanie Beyeler, Senior Portfolio Manager, EFG International

– This contribution is brought to you by EFG, a valued silver event partner of Building Bridges 2024.

Switzerland boasts arguably one of the most coherent ecosystems of green fintechs, affiliated financial institutions and academic partners worldwide, officially supported by the national regulator, the State Secretary for International Finance SIF.

GFN: a powerful network

The Green Fintech Network has grown from a small group of visionary sustainable finance leaders in 2023 to a vibrant network of over 50 members. The key membership consists of startups of various stages, predominantly dedicated to data-gathering and data-analysis, but also in the area of tech-enabled retail and institutional investor assistance. That is why GFN’s member base includes also numerous domestic and internationally leading incumbents, such as financial institutions and professional services firms (UBS, PostFinance, and EY), Switzerland’s exchange SIX Group, global data provider MSCI, and major academic institutions (University of Zurich, ZHAW, and IMD) which provide cutting-edge research, and build a pipeline for science-based spin-offs.

Regulatory developments in Switzerland

The regulator’s focus is on enhancing sustainability disclosures’ transparency and comparability. Presently only targeting large firms, compulsory reporting requirements will increasingly include a larger set of firms. Many SMEs are already required to collect sustainability information due to the trickle-down effect on the whole supply chains of larger firms. Additionally, reporting frameworks are being developed beyond climate and will include nature and biodiversity, just as social aspects. Switzerland aims to strengthen comparability through international platforms and open data, such as the Net Zero Data Public Utility (NZDPU). This presents a great opportunity for Green Fintechs to build technology- and data-enabled tools and solutions, as the focus will be on making primary data broadly accessible, not locking data behind paywalls. Many Swiss green fintechs thus offers data-driven and analytics solutions, benefitting from Switzerland’s world-leading academic institutions in disciplines like data science and AI.

Compliance with EU regulation

Switzerland is greatly affected by evolving EU regulation, as many Swiss corporates are active in the EU market or are suppliers to larger EU corporates that require ESG data for their own reporting. This means the real number of Swiss companies that will have to collect and report sustainability data goes much beyond the 300 large companies, probably by a factor of 10. However, many Swiss SMEs affected do not dispose of the required know-how. There is tremendous scope for green fintechs to assist SMEs in their coming reporting tasks.

Tangible business cases

With the overall direction of the economy transition being clear, a vast space of business opportunities emerges, too. Disclosures and compliance have been the early drivers of the need for green fintech solutions. Now, immense investments are required for the renovation of building stock, industrial processes, agro-economy, and the technologies related sectors are leveraging. New ways of capturing related data, generating real-time insights, monitoring, and ultimately financing will emerge, many strongly tech-enabled. Therefore, some green fintech segments are reinventing and empowering the way the transition can be financed, whether institutionally or individually, whether with public or private money, connecting impact and return.

– Author: Philippe Lionnet, Envoy for Sustainable Finance, State Secretariat for International Finance SIF

– This contribution is brought to you by Finance Swiss, a valued partner of Building Bridges 2024.

Nature-based solutions (NbS) are the most cost-effective approach to addressing biodiversity loss and desertification. They can also contribute over a third of the emissions reductions needed by 2030 to limit global warming to below 2 degrees Celsius. Yet, today, annual investments in nature-based solutions total just USD 200 billion – estimates suggest this needs to increase nearly fourfold by 2050 to deliver internationally agreed nature and climate targets.

At the heart of this growth will be the rise of a circular bioeconomy – an economy based on nature that looks for innovative, nature-positive alternatives to many of the materials and business models we currently rely on. At Building Bridges 2024, the question for policymakers and investors alike – how can we unlock the vital investment needed to support biodiversity and build the circular bioeconomy?

The rise of a circular bioeconomy

Healthy ecosystems are essential in our efforts to control rising temperatures. Every year, the world’s land and oceans absorb more than half of all man-made carbon emissions[1]. Despite this, our economic activities are degrading the natural world, destroying the ability of many landscapes to absorb carbon, turning them instead into vast new sources of emissions.

As we transition to a circular bioeconomy, we will restore these landscapes by uncovering new value in nature. Bio-based materials – such as cross-laminated timber instead of structural concrete, and cellulose instead of steel – will replace some of the unsustainable materials we extract today. And circularity – where we focus on re-use, repair, and recycling – will reduce waste and the need for new materials, while retaining value within the value chain.

Implementing nature-positive supply chains

To achieve this transition at scale, finance is needed. Though there has been an increase in nature investment products – such as payment for ecosystem services, green bonds, and carbon and biodiversity offsets – we also need new products tailored specifically to supply chains in different sectors.

One example is creating new incentives for carbon ‘insetting’, especially in food systems, where regenerative agricultural techniques offer unique insetting opportunities. While traditional carbon off-sets are purchased to counterbalance supply chain emissions, carbon insetting refers to carbon sequestration that happens within a company’s value chain, creating measurable, tangible, and immediate emissions reductions.

Regulations as a catalyst

Regulations – such as the EU’s forthcoming Deforestation Regulation – have a key role to play in closing the nature investment gap. Despite headlines about a political ‘green-lash’, the long-term picture remains unchanged – driven by a need to secure supply chains against the impact of climate change, new regulatory frameworks are increasingly putting pressure on businesses to minimise their impact on nature.

For investors, this is creating the potential for a major revaluation of nature-positive products and services, and the possibility that corporate demand may soon outstrip supply.

The rise of nature-based solutions offers a glimpse of tomorrow’s economy. A circular, bio-based economy that works in harmony with nature rather than at its expense, creates new livelihoods in managing and preserving ecosystems rather than degrading them, and recognises nature as what it really is – our greatest asset.

[1] Biodiversity – our strongest natural defense against climate change | United Nations

– This contribution is brought to you by Lombard Odier, a valued diamond event partner of Building Bridges 2024.

Sizeable scope for making a positive impact

The building industry – including both the construction and use of buildings – accounts for 25% of Switzerland’s carbon emissions. It’s also a heavy consumer of energy and raw materials: some 30% of the energy and 40% of the natural resources used in Switzerland each year are attributable to buildings. This industry also generates 18m tons of waste per year, or 80% of the country’s total.

Some 80% of Switzerland’s buildings date from the last century. So now it’s time to think carefully about how these buildings should be renovated. If we’re to meet Switzerland’s net-zero target, 4% of those buildings will need to be renovated annually – yet we’re currently inching along below 1%. We desperately need to increase the pace of renovation, and circular principles can be a decisive factor in making those renovations more efficient.

Circular thinking means more than just recycling

Many people mistakenly equate the circular economy with recycling. The concept actually extends much further, encompassing three main strategies:

- designing and using products in a more intelligent way

- extending the lifespan of products and components

- making effective use of secondary raw materials.

What that means in practice

For renovation and extension projects, adopting a circular approach means taking several concrete steps to ensure resources are used sustainably. First, a full audit of the existing structure and materials is performed to identify all components that can be reused, thus reducing the need for new materials. This includes assessing the building’s interior and exterior and deciding which materials can be reused on-site or sold on a secondary exchange. Energy audits are then conducted, along with a review of the building’s other systems to check their performance and compliance with the latest standards. And during the design phase, modular features and recycled materials are factored in from the outset, for enhanced flexibility and a smaller carbon footprint.

Taking such steps can deliver major environmental benefits. For instance, waste can be reduced by as much as 60%, shrinking the volume sent to landfills and cutting waste management costs by 10%. A circular approach can also lower carbon emissions by 30% and, thanks to the use of secondary and recycled materials, slash resource consumption by 40%. All this translates into more sustainable construction processes and buildings.

Worth the effort

Embracing circular principles in the building industry will require rethinking our current approach. We’ll need to adopt a holistic view that incorporates social, economic and environmental considerations. Such a shift can go a long way towards cutting carbon emissions and spur the development of more efficient technology. But we’ll need to change our standard practices and address sustainability as early as possible in the design process.

– This contribution is brought to you by Swissroc, a valued silver event partner of Building Bridges 2024.

Julius Baer is one of the first financial institutions in Switzerland to receive validation from the Science Based Targets initiative on its near-term climate targets, confirming that it has a credible plan to reduce its greenhouse gas (GHG) emissions. These targets include reductions from our operations, balance sheet, and a portion of our client assets.

Validation from SBTi, globally the most recognised body certifying climate commitments, shows that our near-term goals are aligned with what the latest climate science deems necessary to limit global warming to 1.5 °C above pre-industrial levels.

What are our SBTi-validated climate targets?

Julius Baer is committed to achieving these climate targets, which have been validated by SBTi:

– By 2025, invest 36% of our balance sheet and discretionary mandate books[1] into companies with validated SBTi targets, (with the aim to reach 100% by 2040).

– Reduce our mortgage GHG emissions by 57% per m2 by 2030 vs 2021.

– Reduce absolute scope 1 and 2 GHG emissions by 90% by 2030 vs 2019.

As a bank, investments make up the majority of our GHG emissions, making it imperative for us to take action in this area. Our stewardship activities, which comprise engaging with companies, exercising voting rights, and engaging with public stakeholders, contribute to achieving our targets on financed emissions.

Driving positive change

Stewardship allows us to take an active role in guiding companies towards more sustainable practices. And it’s a way of using investment power to positively influence how businesses operate and impact society and the environment.

At Julius Baer, we believe that by staying invested in companies, we can more effectively drive positive change through our influence on the company. Where appropriate, we may also join forces with other investors (e.g. through Climate Action 100+), clients, and broader stakeholder groups.

At the same time, we recognise that to be credible to our clients, employees, and other stakeholders, it is paramount of us to walk the talk. We strive to reduce emissions on our own operations through various ways – for instance by promoting efficient energy consumption. We are transitioning to renewable energy across our offices globally, and already source 100% renewable electricity in Switzerland. For the remaining hard-to-abate emissions, we support various decarbonisation initiatives across the world, including sustainable aviation fuel partnerships with global airlines and two reforestation projects in Indonesia and Panama.

[1] Assets classes in scope are listed equity, corporate bonds, ETFs, REITs and corporate loans

– This contribution is brought to you by Julius Baer, a valued silver event partner of Building Bridges 2024.