Insights from the 2023 ESG Global Study

Global ESG Adoption Reaches New Heights

Global ESG adoption among global investors has reached a new high, according to this year’s study. The proportion of adopters inched up by a single percentage point to 90%. This modest rise contrasts with the five-percentage-point increase in adoption recorded in our last report.

Investors’ Proactive Approach to ESG

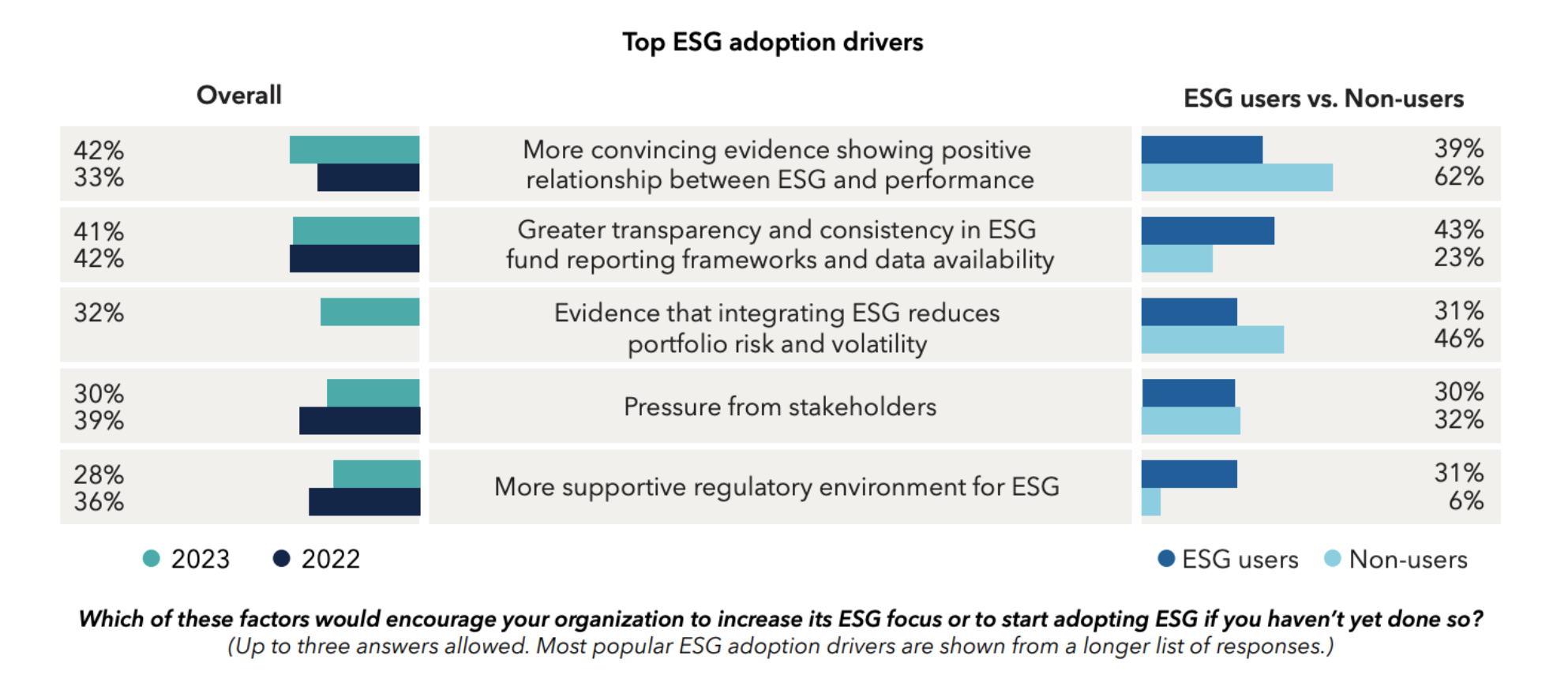

This year’s responses suggest some long-standing barriers are starting to diminish. For example, while investors continue to highlight data quality, regulatory complexity and fund disclosures as barriers to adoption, the level of challenge presented by each of these areas has declined.

Investors appear to be feeling more proactive and more empowered; The more they know about ESG, the more they are finding ways of dealing with its challenges themselves. For instance, investors are devising their own solutions to counter confusion around fund-labeling regimes.

They are also taking proactive steps to decode data difficulties, including accessing ESG data from multiple sources, conducting their own analysis and leaning on asset managers’ proprietary research. Despite these positives, investors think greenwashing* is becoming more prevalent. This shifting perception may be indicative of wider media reporting and heightened regulatory action on greenwashing, rather than increased dysfunction. Going forward, overcoming some of the confusion associated with ESG could help sustain ESG adoption levels. And the ability to articulate the ESG investment case will prove key if more non-users are to adopt ESG.

Catalysts for adoption of ESG

A significant majority of investors who have adopted ESG firmly believe that it has the potential to enhance returns. Nearly six in 10 (57%) say incorporating ESG analysis can uncover attractive investment opportunities. And nearly half (45%) think that integrating ESG is likely to improve long-term investment results. It is not surprising then that most investors favour active strategies, with nearly three-quarters preferring active funds to integrate ESG. More effective engagement and gaining a forward-looking view of company ESG profiles are the reasons most cited by investors for preferring active strategies. Potential alpha generation is identified as a further benefit. This ties in to the potential investment benefits of targeting secular growth themes, of which environmental causes are top of mind. More than seven in 10 (71%) point to the green energy transition as the most important theme. This could reflect rising alarm at the pace of climate change and the impact of geopolitical events such as the Ukraine war.

Advancing ESG: Shifting the Spotlight to Social Factors

Despite a bias toward environmental considerations, a significant percentage of investors want to support a broad array of causes across the sustainability spectrum. Around half of respondents flag “sustainable cities and communities” and “health and wellbeing” as two important themes they consider when selecting ESG funds. Furthermore, investors are alert to the potential risks of focusing solely on the climate aspect of the green energy transition; More investors this year are concerned about social issues being overlooked in the push for climate action.

Many investors therefore have an appetite for a diverse range of ESG themes. And this manifests in demand for funds aligned to the UN Sustainable Development Goals (SDGs). Nearly half say there is a need for multi thematic ESG funds aligned to most of the SDGs. However, demand for these funds is not being met by an appropriate range of products. A significant number of investors point to a lack of suitable SDG-aligned equity, fixed income and multi-asset products.

The Advantages of Multi Thematic Funds and the Benefits of Investing in Transitioners

The diversifying properties of multi thematic funds also hold appeal for ESG investors looking to neutralize investment style biases. Four in 10 (40%) respondents think multi-thematic ESG funds are an effective means of diversifying risks related to style biases. And more than a third (35%) plan to raise allocations to more style-neutral ESG equity strategies over the next 12 months. Investors also point to the importance of holding transitioning companies in portfolios. As well as accelerating the transition to a green future, investors think transitioning companies offer compelling investment opportunities. As such, they are shifting away from a singular focus on ESG leaders, with six in 10 saying strategies investing solely in leaders at the expense of transitioners will miss out on investment opportunities. Instead, they are looking to construct balanced portfolios synthesizing the different but complementary qualities of businesses whose products and services are aligned to ESG-related goals, alongside transitioners that are moving towards alignment. This blended approach offers the prospect of a broader opportunity set, greater diversification and the potential for enhanced investment results.

* Interpretations of what constitutes greenwashing can vary, but broadly the term relates to giving a misleading impression on the ESG or sustainability characteristics of a product, activity or organization.

Guest contribution by Capital Group

Disclaimer:

Past results are not guarantee of future results. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinion of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.